Quick Guide to Creating a Budget Tracking Dashboard

Follow this simple 3-step process to build a Budget Tracking Dashboard using the Five development environment.

Step 1: Set Up Your Application

1. Create a new application in Five by clicking on the Applications section and using the Plus icon to start a new project titled ‘Budget Tracking Dashboard’.

2. Enable the Multiuser feature to allow different users to log into the dashboard.

3. Deploy the application to see its basic structure.

Step 2: Create Your Database

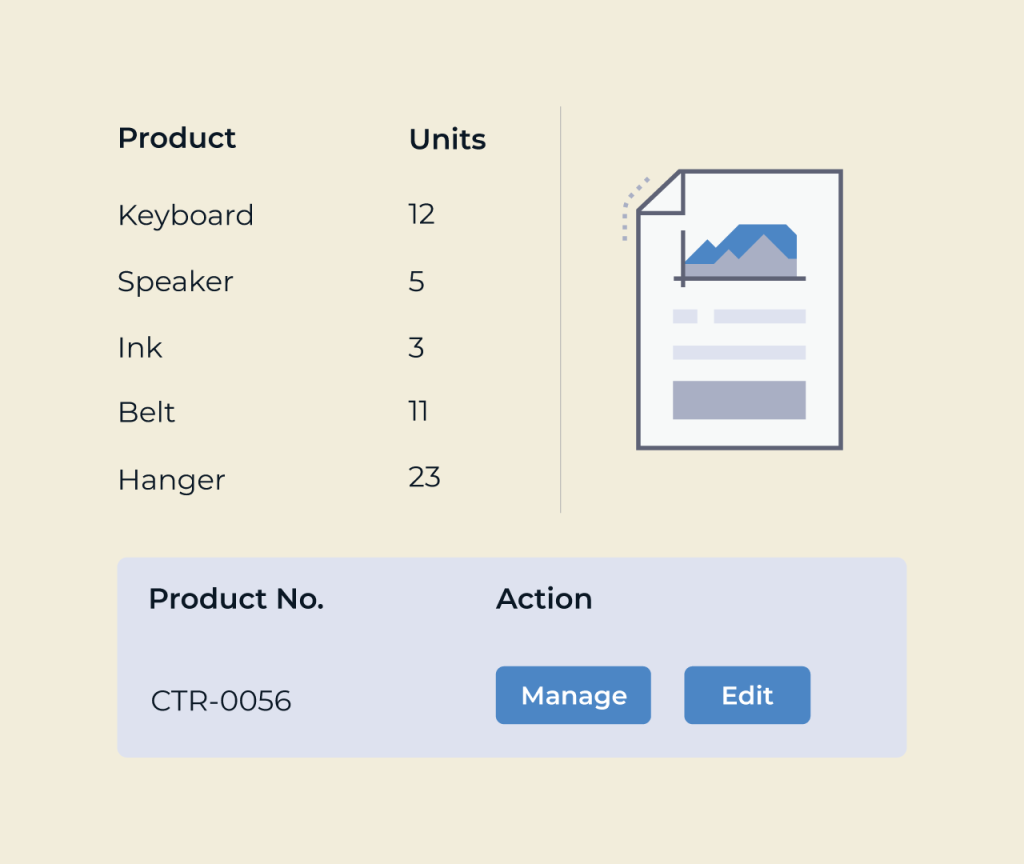

1. Use the Data > Table Wizard to create essential tables in your database like ‘Expenses’, ‘Income’, and ‘Categories’.

2. Define necessary fields for each table, such as ‘Amount’, ‘Description’, ‘Date’, and ‘Category’, ensuring that the data types are appropriate for each field.

3. Establish relationships between these tables if needed, such as linking ‘Expenses’ to ‘Categories’.

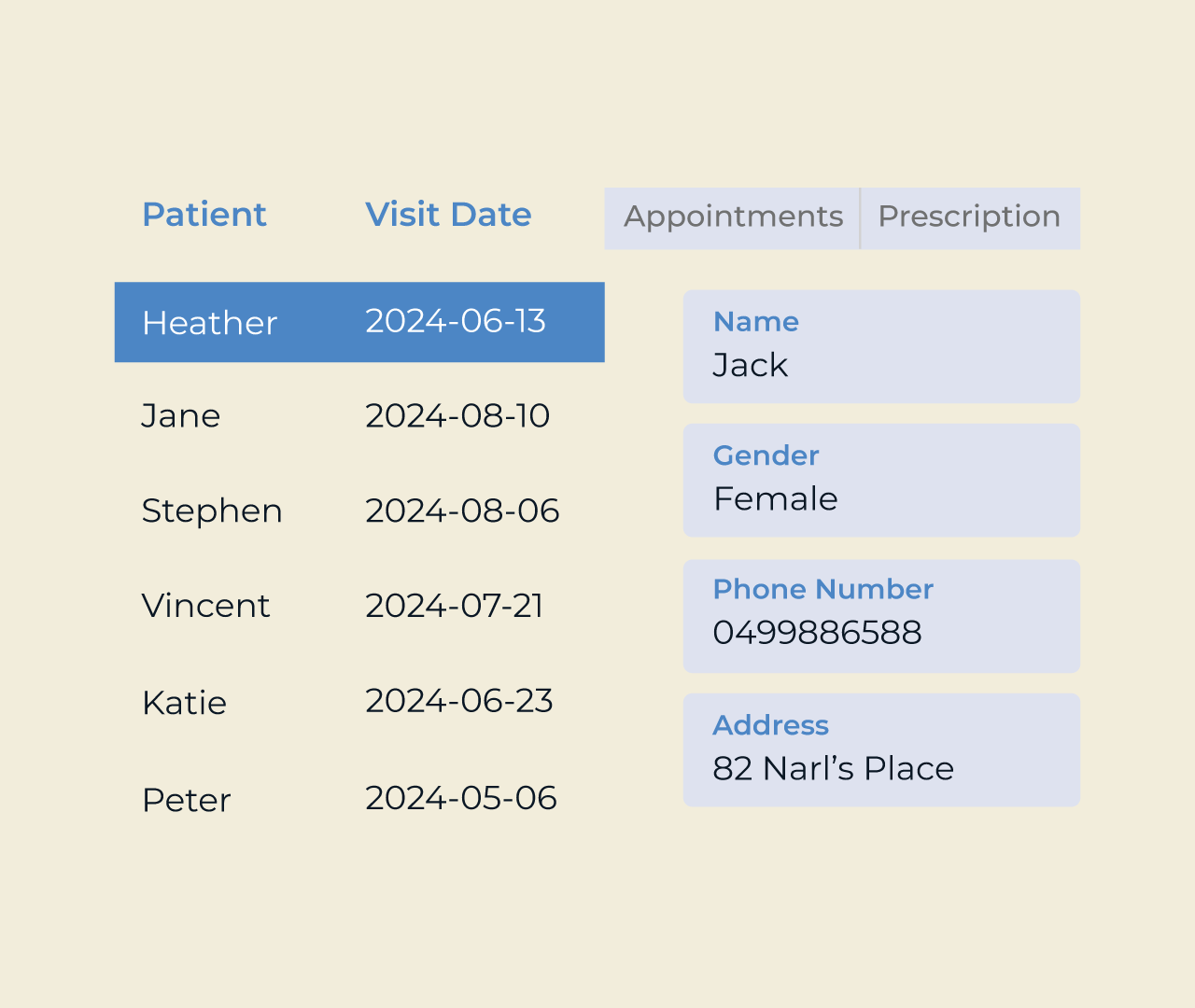

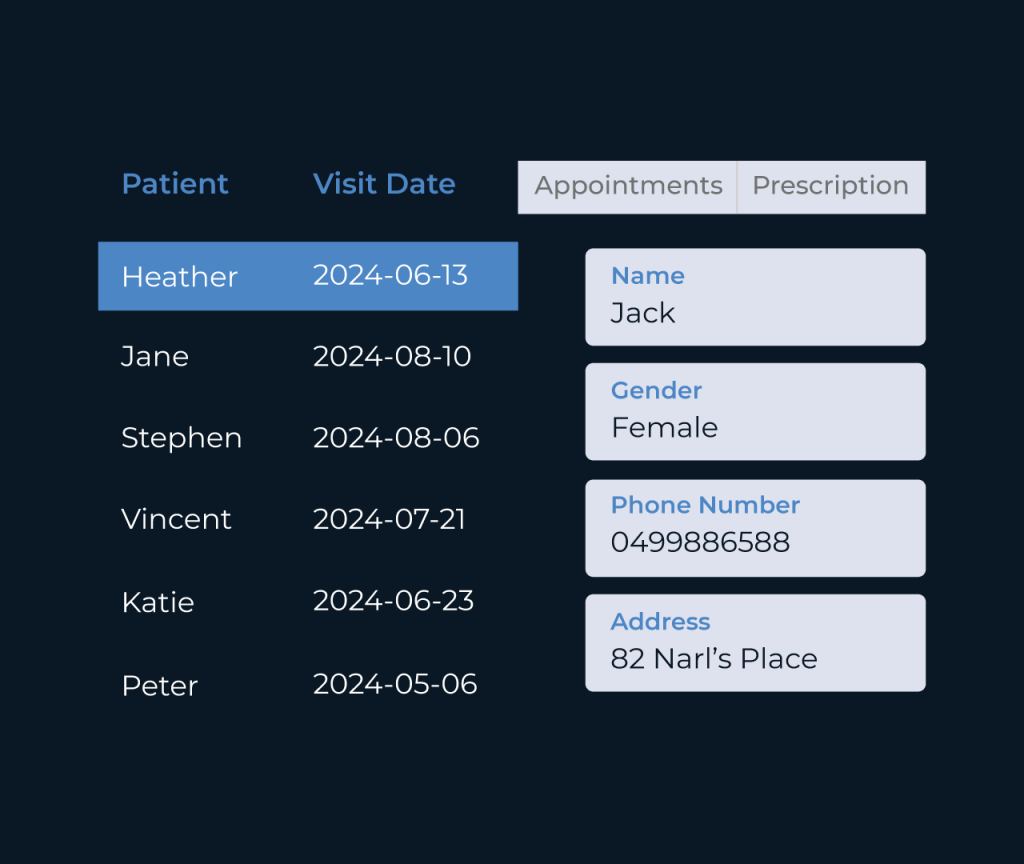

Step 3: Build the User Interface and Features

1. Use the Visual > Form Wizard to create forms that users will use to input their budget data. Include fields for all relevant data points.

2. Develop visualizations using the Visual > Chart Wizard to create graphs that represent spending trends and income sources.

3. Integrate your dashboard with functionality to generate reports and possibly alerts when spending exceeds a set limit.

Your Budget Tracking Dashboard is now ready to help users manage their finances efficiently!