Create A Credit Application Form

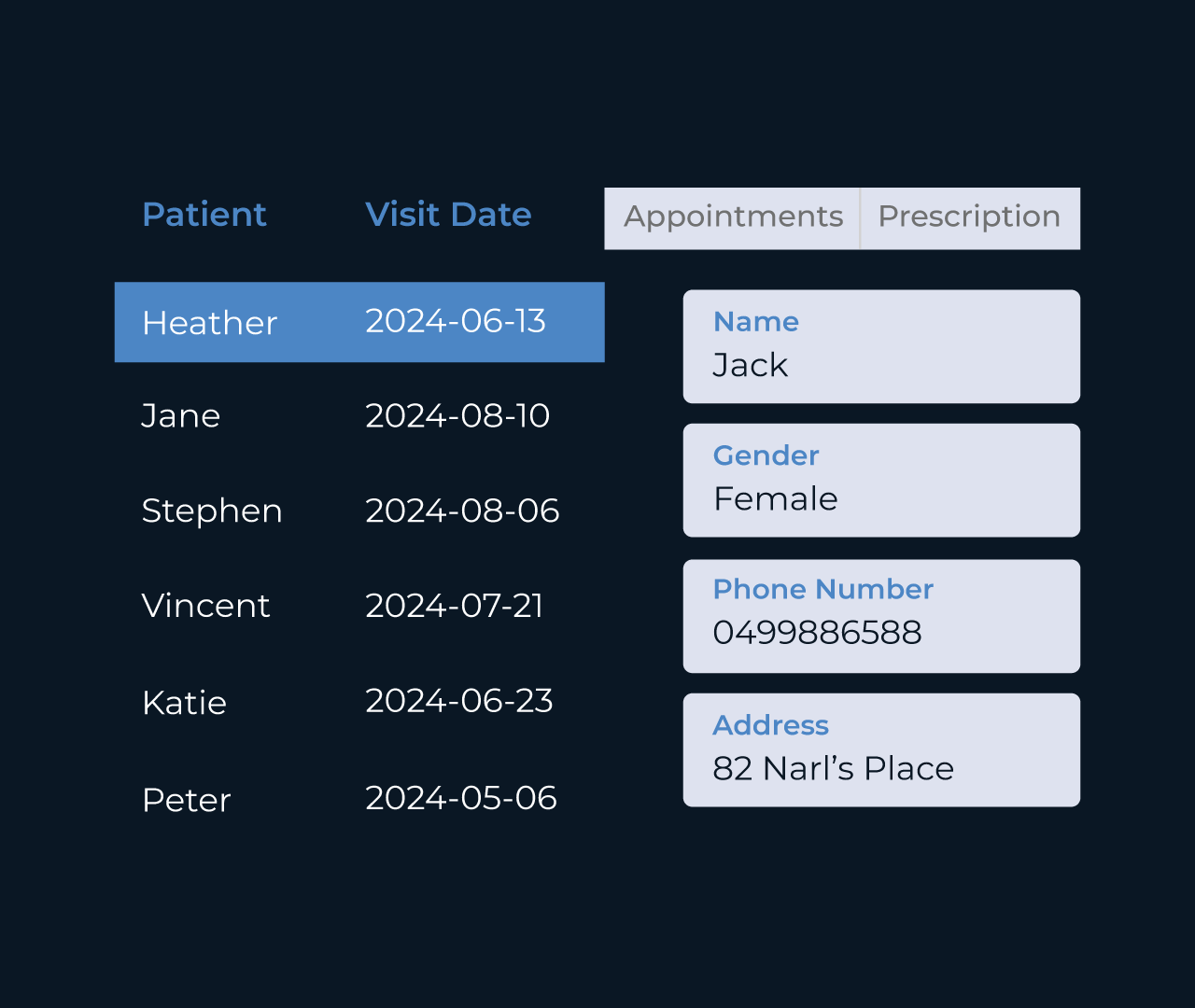

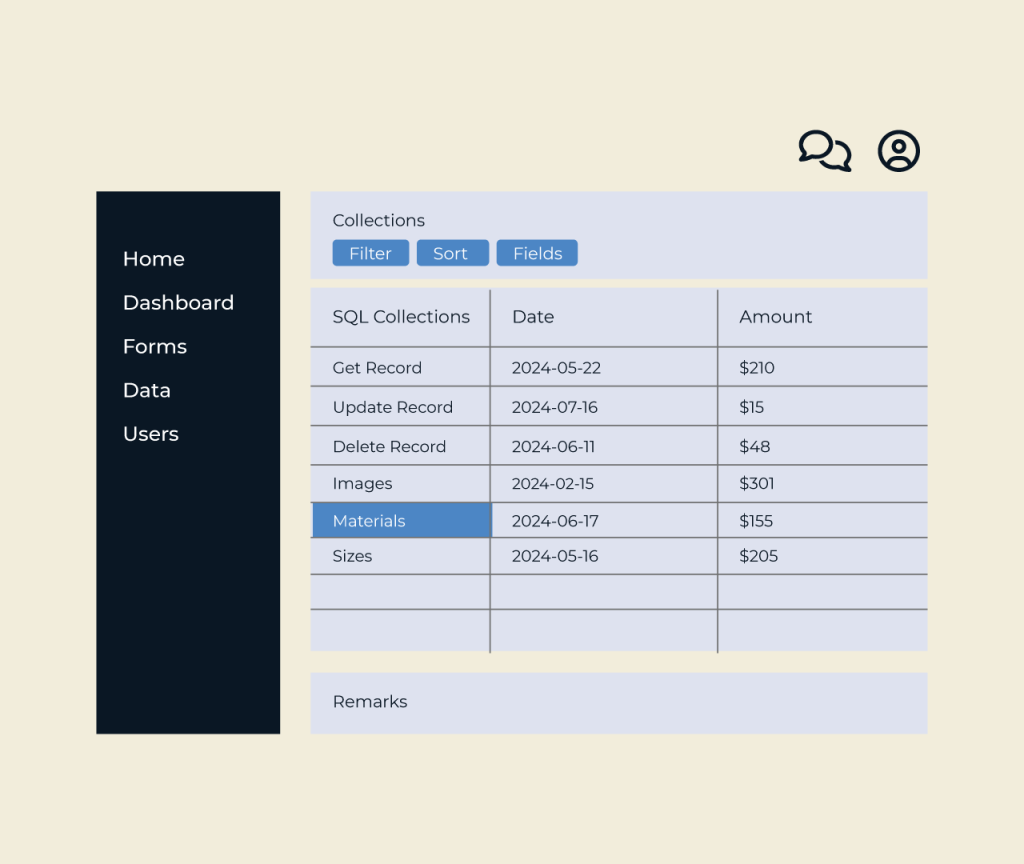

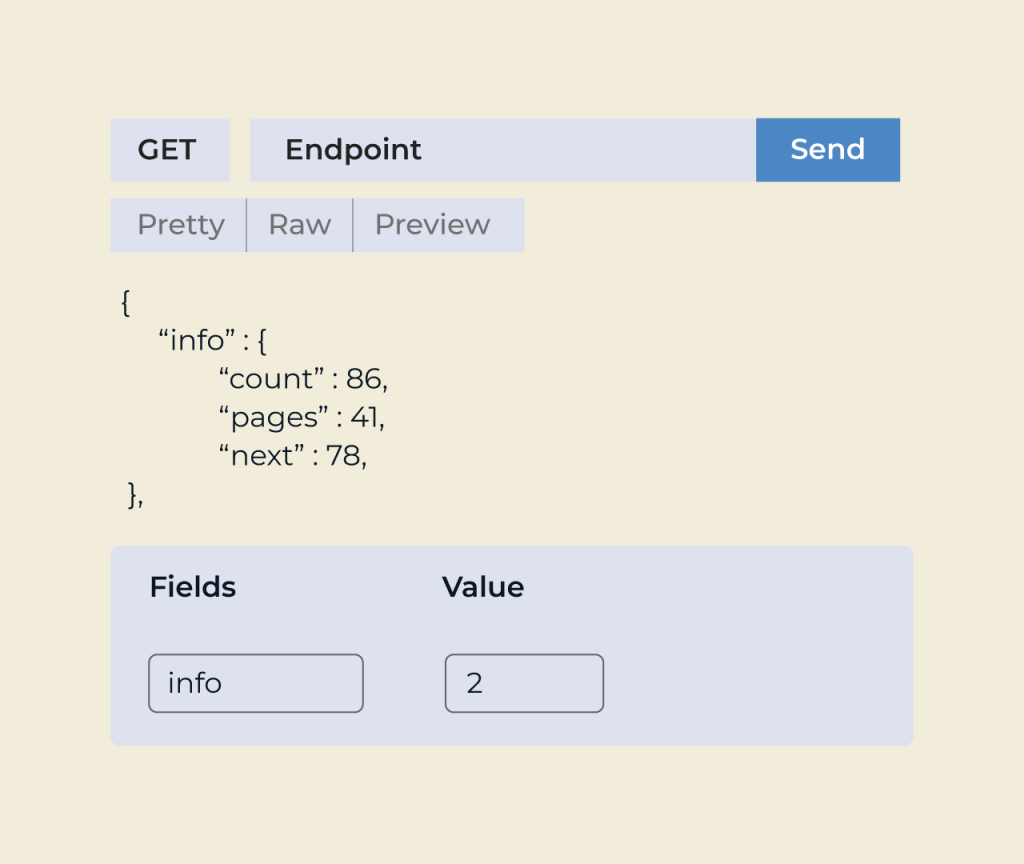

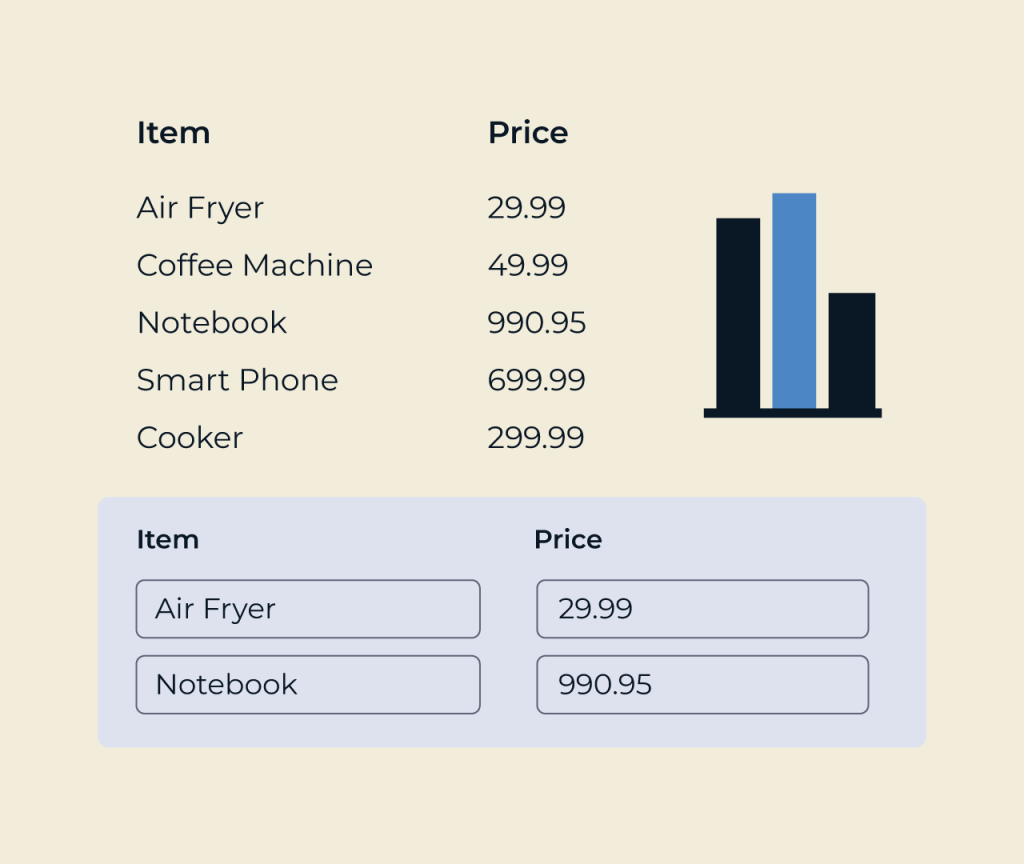

Creating a credit application form is essential for efficiently assessing potential customers. With Five, users can easily design a custom form tailored to their specific needs. The platform’s intuitive interface allows for the inclusion of necessary fields such as personal information, financial details, and credit history.

Five’s features enable seamless data collection and management. Users can incorporate conditional logic to display relevant questions based on previous answers, ensuring a streamlined application process. Additionally, all data is securely stored, making it accessible for future reference and analysis, ultimately improving the decision-making process.