Create a Credit Database

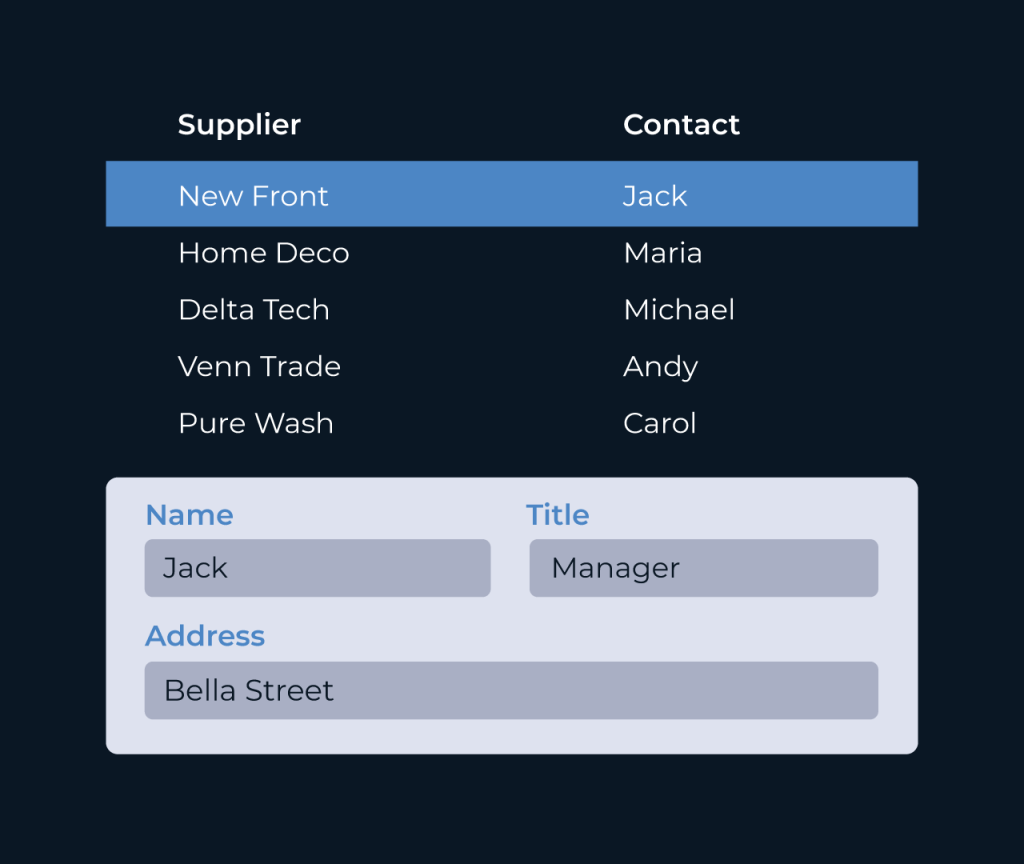

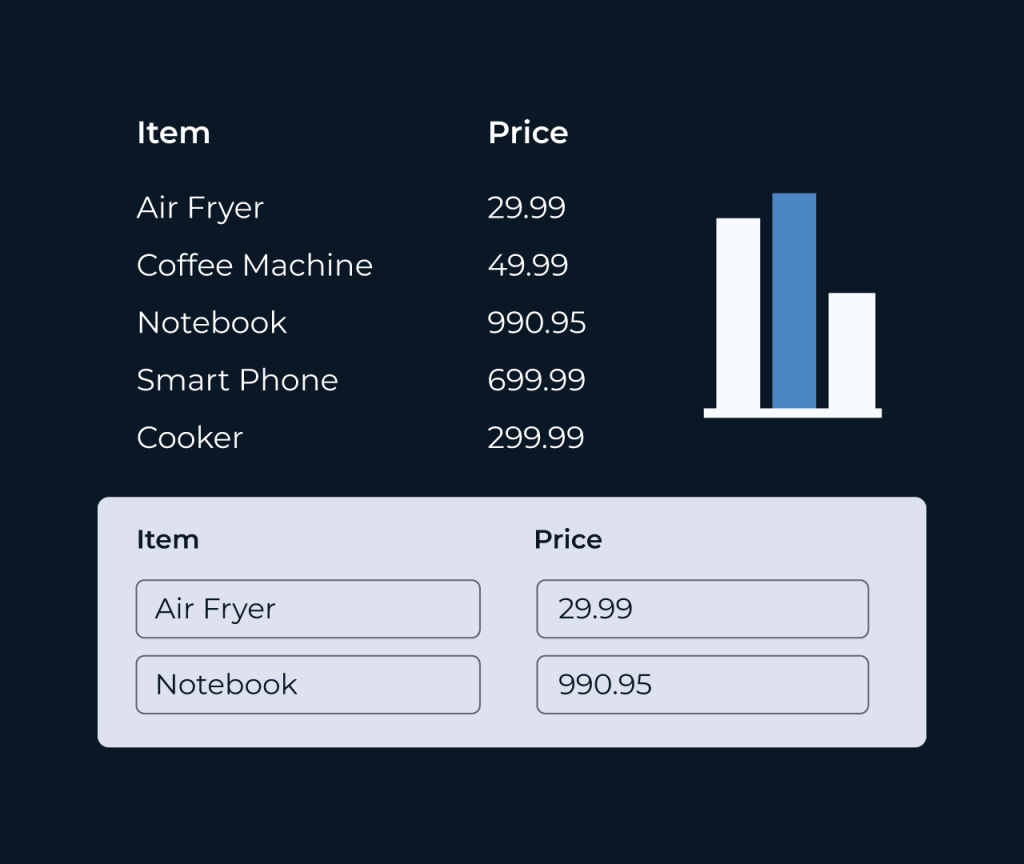

Creating a credit database is essential for tracking credit histories, assessing risks, and managing loans. Five simplifies this process by offering user-friendly tools that enable you to build a comprehensive database tailored to your specific needs. With customizable fields, you can easily input client data, credit scores, and transaction histories.

Five’s platform not only allows for seamless data entry but also provides robust analytics features. This empowers users to gain insights into credit trends and borrower behavior, making it easier to make informed lending decisions. The collaborative nature of Five ensures that all stakeholders have access to the information they need in real-time.