Create a Loan Application Form In 3 Steps

How to Build a Loan Application Form

In this guide, we outline the steps necessary to create and launch a loan application form using Five’s advanced form builder.

The process involves:

1. Creating the database

2. Designing the form

3. Deploying the form

We will also cover securing the form with logins, authentication and permissions, although this is an optional step.

What is a Loan Application Form?

A loan application form is an interface used to gather, store, and manage loan-related data. These forms capture essential information such as borrower details, loan amounts, payment schedules, and repayment statuses, which can be used for tracking, reporting, and decision-making.

Loan application forms can range from simple web forms to more complex systems integrated with databases and analytics tools.

Key Components of a Loan Application Form

- Web Forms: Online forms that users fill out to submit loan-related information.

- Databases: Systems like MySQL, PostgreSQL, or MongoDB that store collected loan data in an organized manner. (Don’t worry if you’re not familiar—Five makes it easy.)

- Data Security: Measures to protect sensitive loan data from unauthorized access and breaches.

- Analytics Tools: Software that allows users to query the database, generate reports, and visualize loan data.

- Dashboards: Interactive interfaces that provide real-time insights and trends on loan applications and repayments.

Why a Traditional Form Builder Might Not Cut it

Loan applications require managing relationships between various pieces of information, such as applicant details, financial history and collateral. Standard form builders typically struggle to handle these complex data structures, making it difficult to create a comprehensive picture of each submission.

Security and compliance are also major concerns in the financial sector. Loan applications contain highly sensitive personal and financial data, requiring security measures to protect this information and comply with strict regulations like GDPR or PCI DSS.

Unfortunately, most off-the-shelf form builders lack the necessary security infrastructure to handle such sensitive data safely and in compliance with these stringent rules.

Furthermore, loan forms also often require advanced calculations, such as determining interest rates, creating repayment schedules and assessing risk. Many standard form builders have limited capabilities, lacking the ability to perform these complex financial calculations accurately and in real-time.

Lastly, the need for advanced reporting and analytics is crucial in the lending industry. Financial institutions require comprehensive tools to analyze application data, track portfolio performance, and generate detailed reports.

Most traditional form builders offer only basic reporting features that fall short of these needs.

Building a Loan Application Form with Five

Creating a loan application form in Five offers significant advantages over traditional form builders, making it ideal for those who need robust, secure, and analyzable loan data.

Unlike traditional form builders, which only store submitted data, Five allows you to directly connect your loan application form to a database. This connection enables you to query your database and generate visual representations of your data, making it easier to identify trends, patterns, and repayment behaviors. Most traditional form builders require exporting data to third-party tools for analysis, adding extra steps and potential for errors.

While traditional form builders may suffice for very basic loan application tasks, they often struggle with large datasets or high submission volumes. Five’s database-connected solution, on the other hand, is designed to handle substantial amounts of loan data efficiently, maintaining performance as your application needs grow.

One of the standout features of Five is the ability to create login-protected forms. This ensures that only authorized users can access and submit loan data, enhancing the security of your loan application process. Traditional form builders often lack these advanced security features, leaving your data vulnerable to unauthorized access.

In addition to its advanced data management and security features, Five allows you to build dashboards and generate detailed reports directly from your loan application data.

You can create visual data representations such as charts and graphs, providing a clear overview of loan statuses, application trends, and repayment schedules.

With Five, you can:

- Quickly deploy your data application form with a secure database.

- Build a user-friendly interface that protects sensitive data with login authentication.

Step 1: Database for Your Loan Application Form

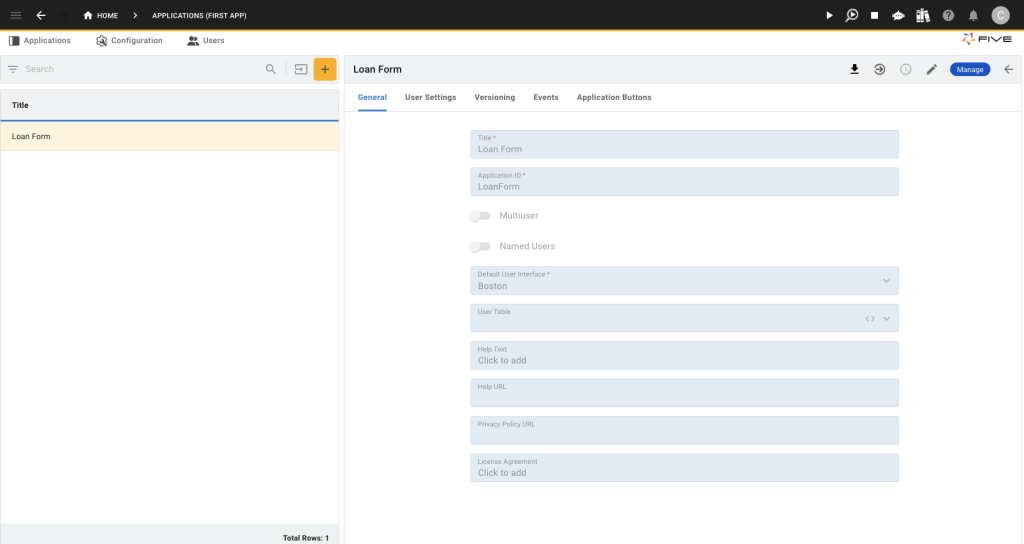

To get started, sign up for free access to Five and create a new application by navigating to the Applications section and clicking the yellow plus button.

Create a New Application:

- Click the yellow plus button.

- Name your application (e.g., “Loan Form”).

- Confirm by clicking the check icon in the upper right corner.

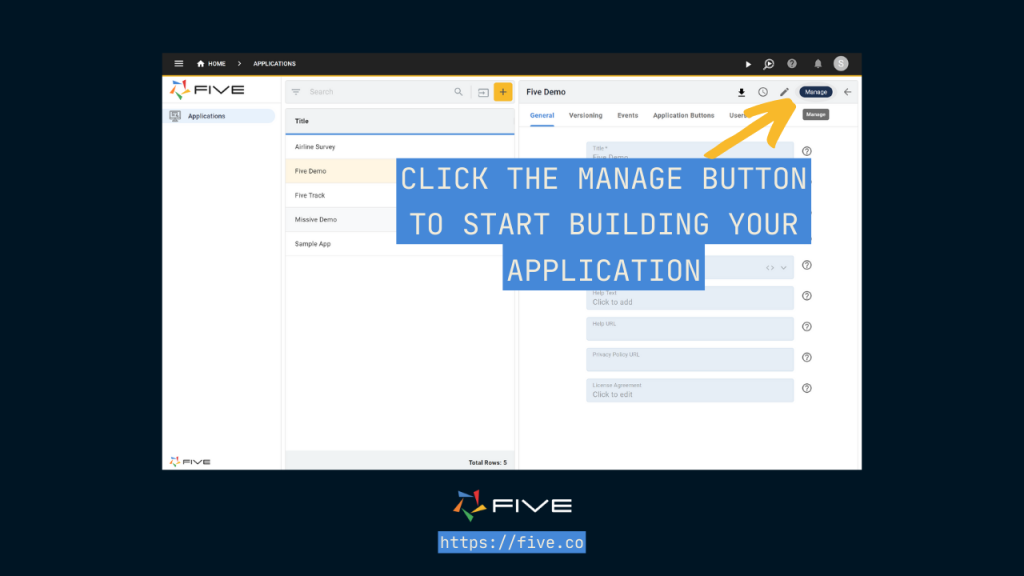

- Click on the blue Manage button to enter the development environment.

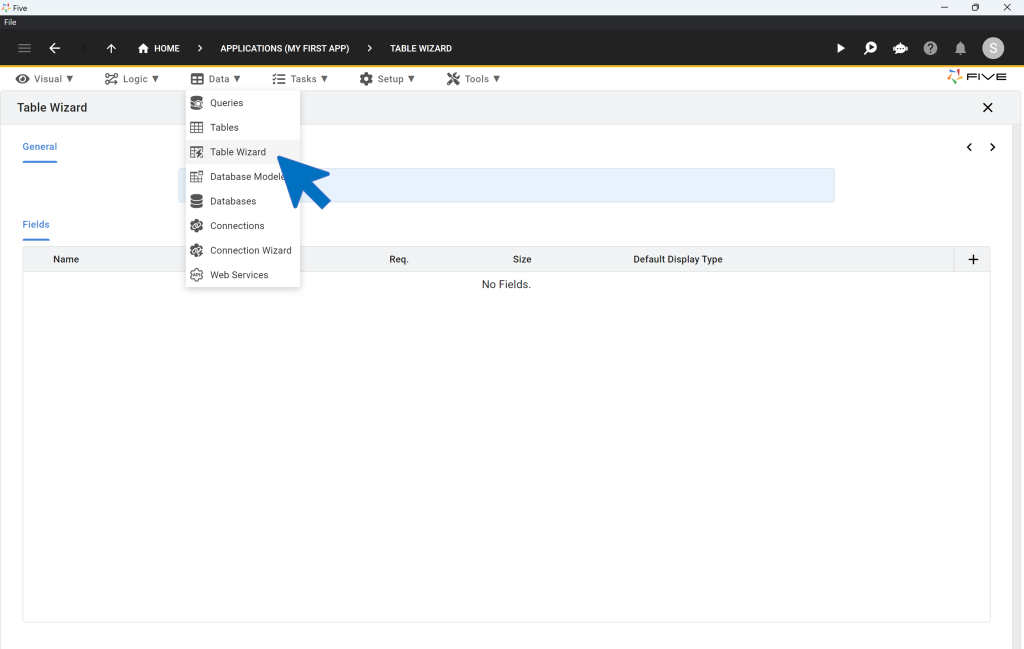

Create Database Tables:

- Go to Data > Table Wizard, a user-friendly interface for creating database tables.

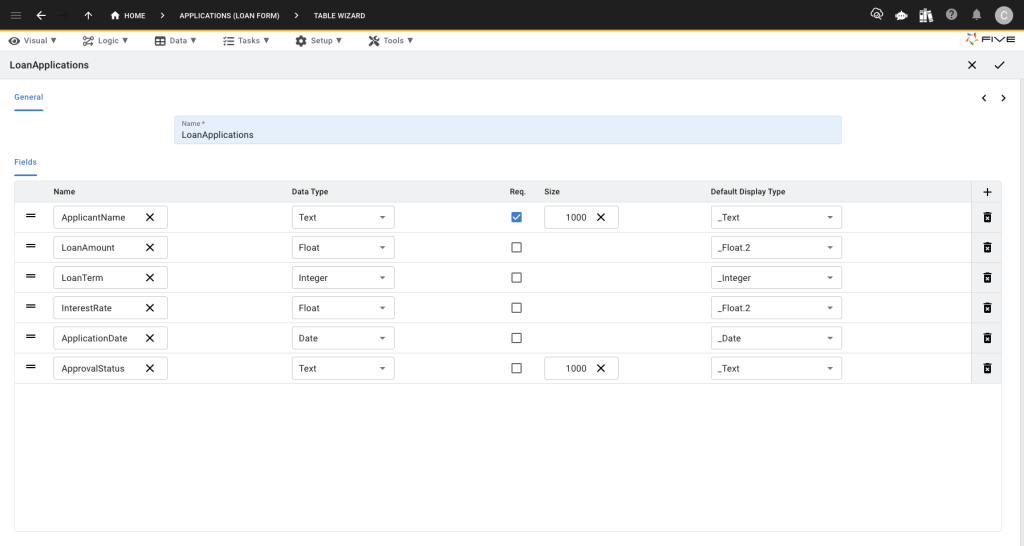

- Name your table descriptively (e.g., “LoanApplications”).

- Add fields to your table using the plus button, specifying appropriate data types:

- ApplicantName (Text): Stores the name of the loan applicant.LoanAmount (Float): Captures the loan amount requested, with two decimal places.LoanTerm (Integer): Stores the loan term in months.InterestRate (Float): Holds the applicable interest rate, precise to two decimal places.ApplicationDate (Date): Records the date the loan application was submitted.ApprovalStatus (Text): Indicates whether the application is pending, approved, or rejected.

Save Your Database Table:

- After adding all relevant fields, save your table by clicking the check icon in the upper right corner. Your MySQL database table is now ready to store loan application data.

Side Note: This might seem more advanced than what you were expecting but nothing worth having comes super easy. Five excels at building complete applications as well, which means you can actually expand your form into a fully fudged application capable of a lot more than a standard form builder.

Step 2: Designing the Loan Application Form

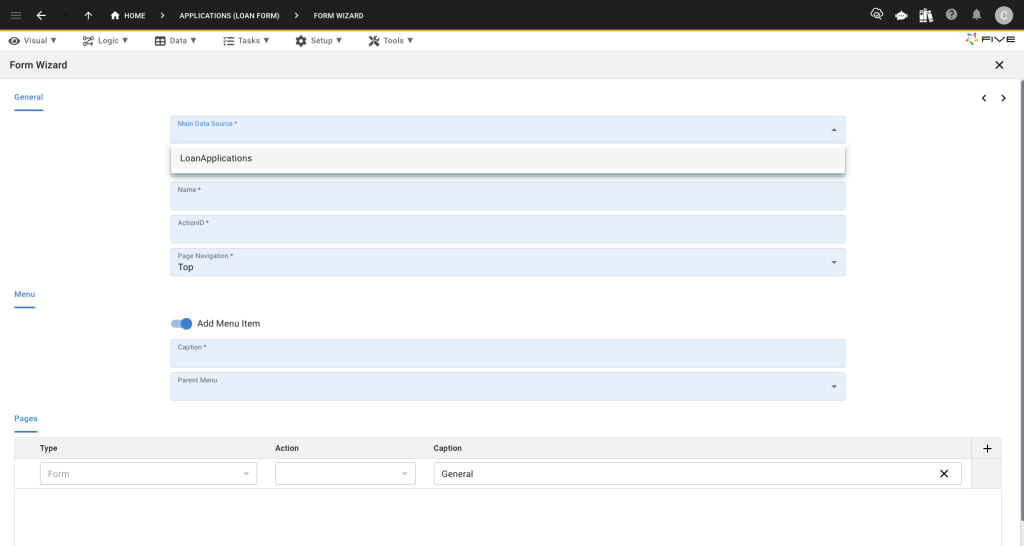

Next, navigate to Visual > Form Wizard in Five to design your loan application form.

Select Data Source:

- In the Form Wizard’s General section, select the “LoanApplications” table you created as the main data source. This links your backend (database) with your frontend (form).

Finalize the Form:

- Click the check icon in the upper right corner to complete the form creation. Your form is now ready and connected to your database.

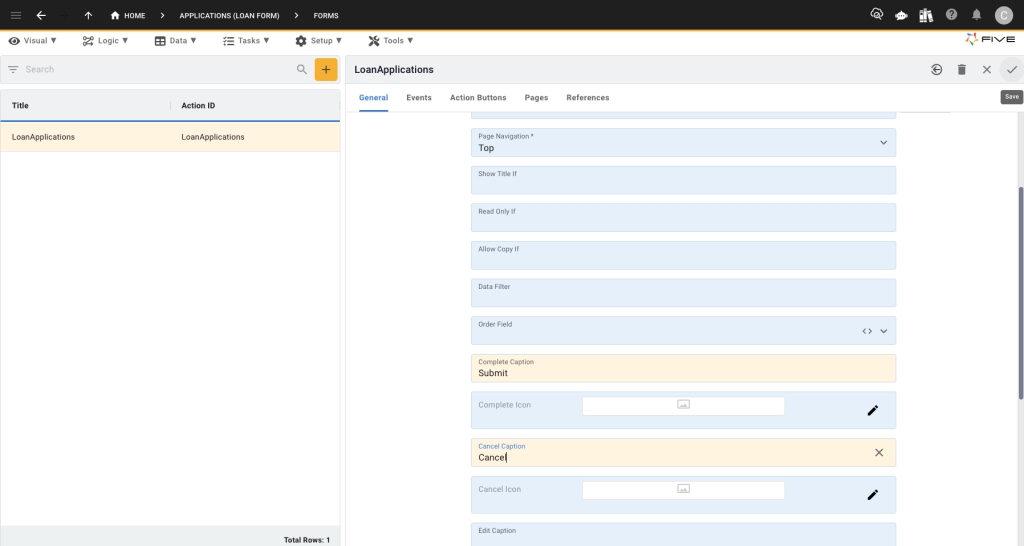

Add Form Submit/Cancel Buttons

Next navigate to Visual then select Forms and scroll down. Under Complete Caption you can add your submit button (you can change this to whatever you’d like). You can also change the Cancel Caption. Remember to click the tick to save afterwards.

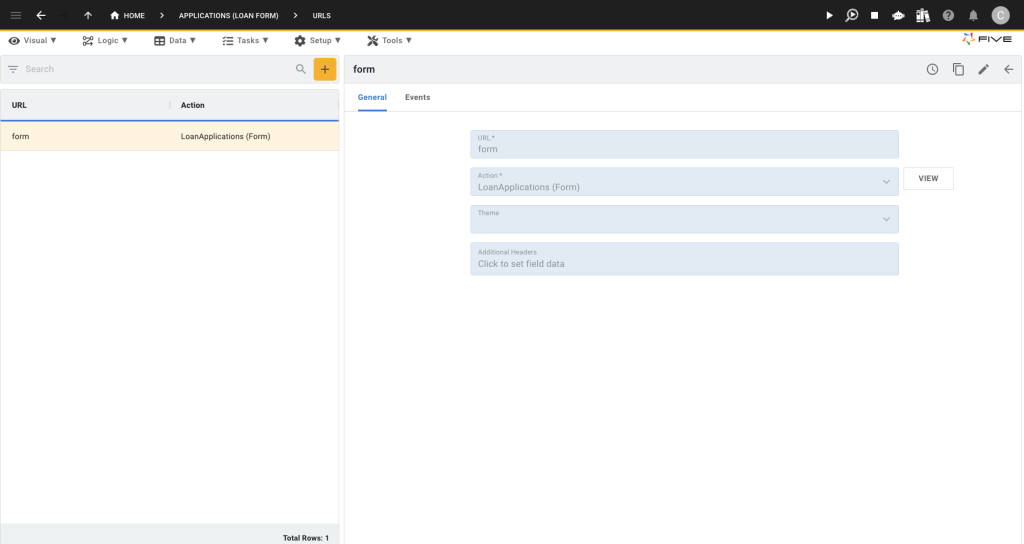

Add your URL

Next you need to add your URL. Navigate to Setup then select URL and add an item. You must make this lowercase.

Also select your form in the action field.

Step 3: Deploying the Loan Application Form

To deploy your loan application form:

Deploy to Development:

- Click the “Deploy to Development” button in the top right corner. This action opens your loan application form in a new browser tab, allowing you to preview it.

Once you run your application your default URL will look something like this: https://control-default-loanform-ryan.5au.dev/?reloadSchema=7b2081af-aba0-4fbd-86c3-ebbd4711014f&inspect=false

Delete this URL section ?reloadSchema=7b2081af-aba0-4fbd-86c3-ebbd4711014f&inspect=false and replace it with what you named your URL above:

Based on this demo the new url would be https://control-default-loanform-ryan.5au.dev/url/form and this will lead you to your form.

Enhance Your Form:

- Consider adding themes or additional features, such as conditional logic to guide applicants through the process or automated emails confirming submission.

Securing Your Loan Application Form: Logins, Authentication, Permissions

Remember the benefits of Five are quite significant compared to simple form builders. Five goes beyond data collection and allows you to build web applications with custom logic and dashboards. So although the process may not be as “conventionally easy” as Google Forms, Five’s overall capabilities are more advanced.

One of these added benefits is security. Namely the ability to add a login protected backend for submitted form data.

Here are the steps to add user roles and logins:

- Turn your application into a multi-user app by automatically adding a login screen.

- Create user roles with specific permissions. For example:

- Applicant Role: Can submit loan applications.

- Admin Role: Can review applications, approve or reject loans, and access the dashboard summarizing all submissions.

Explore More Security Features:

- Utilize Five’s documentation for detailed instructions on securing your loan application form with authentication and permissions to ensure only authorized users can access or modify data.

To learn more about Five and expand out your form check out some of our code-along articles.

Conclusion: Building a Loan Application Form

Building a loan application form with Five’s application development environment offers numerous advantages over traditional form builders.

The process involves three key steps: creating the database, designing the form, and deploying the web form. Five’s provides security features, including login protection, authentication, and user permissions, ensuring that your loan application form is secure and only accessible to authorized users.

By using Five, you can directly connect your loan application form to a database, enabling efficient data management and real-time analysis through custom charts and reports.

This capability allows you to easily track applications, monitor approval statuses, and manage loan data effectively—tasks that are often cumbersome with traditional form builders that require exporting data to third-party tools.

With Five, you can improve your loan application process, enhance data security, and leverage analytical tools to gain insights, making it the superior choice for creating a comprehensive and efficient loan application form.

What Else You Can Do With Five

Here’s a more advanced form for property booking, this shows Five’s calculation capabilities.