Create a Payroll System In 3 Steps

How to Create a Payroll System

A payroll system is a web-based platform that provides businesses with a centralized system to manage all payroll-related activities, including employee salary calculations, tax deductions, benefits administration, and financial reporting.

Payroll systems centralize important services and information, such as employee records, payroll schedules, tax forms, and benefits management, all in one place, making it easier for organizations to process payroll accurately and on time.

However, creating a payroll system can seem challenging, especially if you don’t have technical coding knowledge.

That’s where tools like Five come into play, making it easier to develop and deploy a customized payroll system without extensive coding expertise.

Why Do You Need a Payroll System?

A payroll system provides businesses with a centralized platform to handle all payroll-related tasks. This includes managing employee salaries, processing tax withholdings, calculating benefits, and generating financial reports.

From tracking employee hours to ensuring compliance with tax regulations, a payroll system improves operations, making it easier for organizations to pay their employees accurately and on time.

For HR professionals and payroll administrators, the benefits are just as significant. A payroll system reduces the administrative burden by automating tasks such as salary calculations, tax filing, and benefit management. This saves time, minimizes errors, and ensures that all payroll data is organized and easily accessible.

Admins can also use the system to monitor payroll processing, track tax obligations, and maintain an updated employee database, all from one platform.

Components of Your Payroll System

When building your payroll system, you likely have some key features in mind, but there are a few essential components you might not have considered.

Employee Record Management: A robust system for managing employee records is crucial. This includes storing personal information, salary details, tax information, and employment history.

Salary and Wage Calculations: The system should automate the calculation of employee salaries, including overtime, bonuses, and deductions for taxes, benefits, and other withholdings.

Tax Compliance and Reporting: Managing and calculating tax withholdings, generating W-2s, and ensuring compliance with local, state, and federal tax regulations are vital parts of payroll processing.

Benefits and Deductions Management: The system should handle employee benefits, such as health insurance, retirement plans, and other deductions, ensuring they are accurately reflected in payroll calculations.

Payroll Schedules and Processing: The system should allow for the scheduling of payroll runs and ensure that employees are paid on time, whether on a weekly, bi-weekly, or monthly basis.

Reports and Analytics: Having access to payroll data is key. Your system should generate reports on various aspects of payroll, such as total payroll costs, tax liabilities, and benefits distribution.

Security Features: Payroll data, including employee salaries and tax information, is sensitive. A good payroll system will include encryption, user authentication, and secure data storage to protect this information.

Build or Buy Your Payroll System

When implementing a payroll system, businesses face a critical decision: should you build a custom solution or buy an off-the-shelf product?

With tools like Five, you can build exactly what you need without unnecessary features that add complexity. This allows you to tailor the system to your specific payroll requirements, ensuring a solution that aligns perfectly with your company’s payroll process.

Building a custom payroll system also allows for integration with your existing tools, such as HR software, accounting systems, or benefits management platforms. This ensures a seamless experience across your systems and improves overall payroll efficiency.

In contrast, off-the-shelf solutions may have limitations, such as not fitting your exact workflow or exposing your data to third parties. A custom solution built with Five gives you full control over your payroll data and its security.

Creating a Payroll System Can Be Easy

Creating a payroll system used to require extensive coding knowledge, which often led businesses to hire “expert developers” at great expense. Fortunately, times have changed, and now tools like Five simplify the process, making it quicker and more accessible.

With Five, you no longer need to learn complex coding languages or spend hours researching expensive off-the-shelf solutions with high licensing fees. Instead, you can get started right away and have your payroll system built and running in a short time.

While there may be a slight learning curve, this approach is objectively better than traditional methods.

With Five, you can:

- Set up your web interface in minutes: Create a fully functional, custom payroll system without extensive coding knowledge.

- Create a user-friendly, login-protected web interface: Ensure that only authorized users can access sensitive payroll data, enhancing security.

- Easily import your existing data: Get started quickly by importing your current employee records, salary details, and tax information, making the transition smooth and efficient.

Get free access to Five here and start building your payroll system today.

How to Create a Payroll System with Five

If building your payroll system with Five sounds appealing, here’s a quick guide to get you started.

Step 1: Access Five

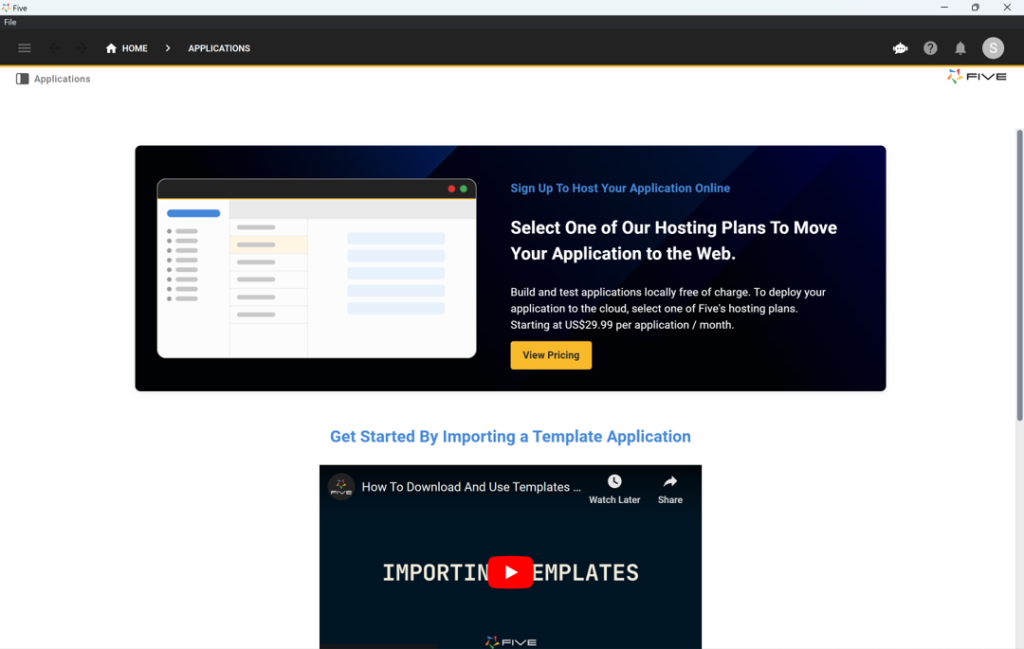

If you haven’t already, sign up for free access to Five. Five offers a 14-day free trial with no credit card required. Depending on your project’s complexity and data storage needs, you may need to upgrade to a paid plan later.

Step 2: List Out System Attributes

Start by compiling a comprehensive list of all the attributes relevant to your payroll system. Consider what matters most to your payroll operations: employee records, salary calculations, tax deductions, benefits management, and more. Your payroll system should serve as a “single source of truth,” so make sure it’s as complete as possible.

Here are some essential attributes typically included in a payroll system:

- User Authentication and Profile Management: Securely manage who has access to the payroll system, including roles for HR staff, payroll administrators, and employees.

- Employee Records Management: Store essential employee information such as personal details, salary rates, tax information, and employment history.

- Salary and Wage Calculations: Automate the process of calculating salaries, including overtime, bonuses, and deductions for taxes and benefits.

- Tax Compliance and Deductions: Track and calculate tax withholdings, generate tax forms, and ensure compliance with local, state, and federal regulations.

- Benefits and Deductions Management: Manage employee benefits such as health insurance, retirement plans, and other deductions directly within the payroll system.

- Payroll Schedules and Processing: Set up payroll schedules and ensure timely payment of wages, whether on a weekly, bi-weekly, or monthly basis.

- Reporting and Analytics Tools: Generate detailed reports on payroll expenses, tax obligations, and employee earnings.

Follow our YouTube tutorial on developing a membership application, which shares many similarities with a payroll system. This seven-step guide covers everything from database modeling to previewing your completed application. The first tutorial step explains how to create a database table in Five.

This four-and-a-half-minute video is highly recommended if your primary goal is developing a payroll system.

The video also demonstrates how to assign different SQL data types to your table fields and visually inspect your database schema using Five’s database modeler. Additionally, it shows how Five automatically adds primary keys to all your tables.

Step 3: Launch Your Payroll System Online

Once your payroll system database is ready and well-structured, you can begin populating it with the necessary data.

Using Five, you can easily upload CSV files directly into your database. Ensure that the columns in your CSV align with the fields in your database, and import the data into your database tables.

Additionally, you can create a user-friendly, web-based graphical user interface with Five. This interface can feature forms for adding or editing employee details, charts for visualizing payroll trends, and the ability to generate PDF reports, such as pay stubs or tax summaries, using data from the database.

When you’re ready to deploy your payroll system, sign up for one of our paid plans, starting at just $29.99 per month per application. This plan includes unlimited end-users and provides you with a custom URL to access the system online.

For more detailed guidance, check out one of our step-by-step code-along guides.

Conclusion: Building a Payroll System

A well-designed payroll system is essential for businesses managing employee compensation and tax obligations. With tools like Five, creating a custom payroll system has become more accessible than ever.

No longer do businesses need to settle for one-size-fits-all solutions. Instead, they can rapidly build and deploy a payroll system that truly meets their operational needs.

Get free access to Five here and start building your payroll system today.