Create an Accounting Database In 3 Steps

Build Your Accounting Database in Just 3 Steps: A Guide to Better Accounts [Template Available]

Accurate accounting is the backbone of any successful business. From tracking income and expenses to managing accounts receivable, preparing balance sheets, and monitoring cash flow, efficient financial management ensures smooth operations and long-term viability. An accounting database is the right tool for storing and managing your financials.

While many small and medium-sized businesses start with spreadsheets for their accounting needs, these solutions often fall short as companies grow. Issues like data inaccuracies, version conflicts, and scattered information can get in the way of decision-making and increase operational risks.

An accounting database offers many advantages. It is a reliable and scalable alternative, providing centralized, accurate, and secure financial data management. In this guide, we’ll show you how to create an accounting database tailored to your business needs in just three simple steps.

- Build Your Accounting Database in Just 3 Steps: A Guide to Better Accounts [Template Available]

- What Is an Accounting Database?

- Why Build an Accounting Database?

- Accounting Databases in Excel

- Accounting Database Template App

- Professionalize Your Accounting Management

- How to Create an Accounting Database in 3 Steps

- Accounting Database Schema and Features

What Is an Accounting Database?

An accounting database is a structured system designed to store, organize, and manage financial data. Its primary purpose is to track all financial transactions and maintain accurate records of the organization’s financial activities.

It centralizes accounting transactions, making it easier to track and record key financial activities like revenues, expenses, and payments. The database is used for storing essential accounting data that goes into a company’s financial statements, i.e. its balance sheets, profit-and-loss (P&L) statement, and cash flow statement.

By consolidating all financial records in one secure location, an accounting database improves accuracy and accessibility. Businesses can generate reports to analyze financial health, assess performance, and support decision-making.

With a well-designed accounting database, businesses can streamline processes, minimize errors, and gain a clearer view of their overall financial position.

Why Build an Accounting Database?

An accounting database is crucial for businesses because it ensures that financial information is systematically organized, stored properly, and easily accessible.

The accounting database serves several key purposes:

1. Financial Record-Keeping

It provides a centralized repository for all financial data. Every transaction is recorded and easily accessible. This includes sales, purchases, payroll, tax payments, and other financial activities.

2. Reporting and Analysis

An accounting database supports the generation of financial reports such as balance sheets, income statements, and cash flow statements. These reports are typically required for regulatory purposes. Of course, they are also essential for assessing the financial health of the organization and making informed business decisions.

3. Budgeting and Forecasting

By organizing historical financial data, an accounting database helps in creating budgets and forecasting future financial performance. This enables organizations to plan their finances more effectively and allocate resources efficiently.

4. Compliance and Auditing

The database ensures that financial records are kept in accordance with legal and regulatory standards. It also facilitates the auditing process by providing a clear, traceable history of all financial transactions.

5. Internal Controls

An accounting database often includes features for monitoring and controlling access to financial data, helping to prevent fraud and errors by maintaining integrity and security over financial records.

Last, a database is secure, scalable, and not as easily compromised or tampered with as a spreadsheet, for example. A database can be protected from unauthorized access through logins or user roles.

Accounting Databases in Excel

When creating a custom accounting database, many people start with tools like Microsoft Excel or Google Sheets. Especially in finance and accounting, Excel spreadsheets reign supreme!

While these spreadsheet-based solutions can be convenient for smaller businesses or those who start a new business from scratch, they often lead to significant issues. Spreadsheets are not recommended for more professional financial management.

Here are some common problems associated with using spreadsheets:

1. Security Breaches:

Spreadsheets cannot be easily secured or protected from unauthorized access. Excel or Google Sheets do not directly support user roles, authentication, or granular access control.

2. Version Confusion:

Local copies of the spreadsheet proliferate and develop a life of their own. This leads to multiple versions like “CashFlow2024_NEW,” “PayrollDabase – v2.1,” “Financials – Old – DO NOT USE,” etc.

3. Lack of Version and Access Control:

Without clear ownership or version control, changes made by staff can be lost or duplicated, especially if the person responsible for updates leaves the company and a new person takes over.

4. Data Inconsistencies:

Comments, highlights, and manual updates lead to a cluttered and error-prone spreadsheet.

Setting up your accounting database in a spreadsheet can ultimately defeat the purpose of having a single, reliable source of truth. Instead of efficient financial management, you end up constantly fighting fires, searching for critical data, or managing and cleaning up multiple spreadsheets.

Ditch Excel For Better Data Management

Excel or spreadsheets aren’t the right solution for accounting management. What’s a better alternative?

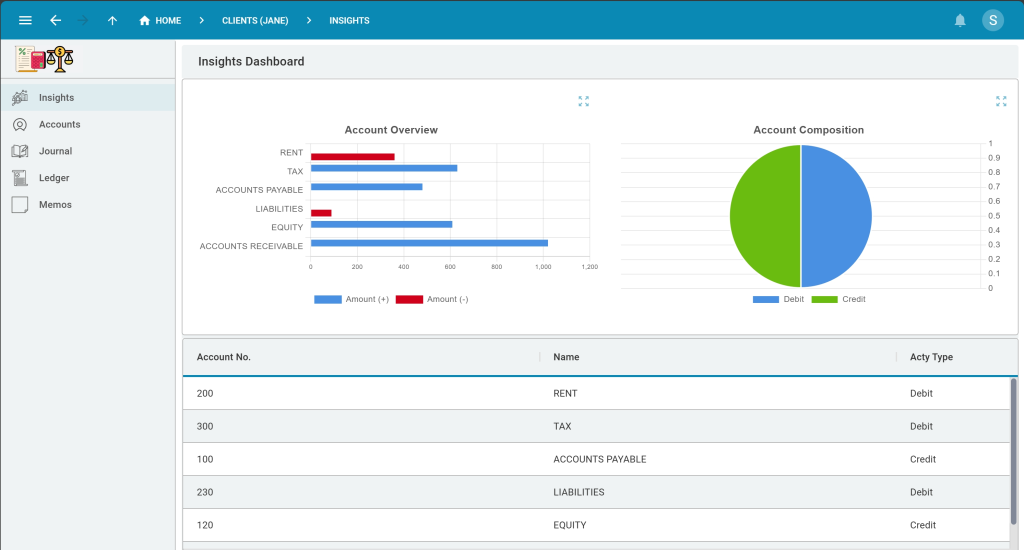

An accounting database with an intuitive web user interface! Check out our accounting database template app for a visual impression of an application developed with Five.

Professionalize Your Accounting Management

Five gives you all the essential tools to build and launch a modern accounting database application:

- Access to Five’s rapid development environment.

- A customizable, cloud-hosted MySQL database for storing accounting data.

- A library of pre-configured template applications, ready for use.

Get started with one of our affordable subscription plans or sign up for a free trial first.

Five has a team of experts ready to assist you with your accounting database development. So, if you ever feel like you’re in over your head, don’t worry, our expert developers are here to help. And yes, we promise not to charge you an arm and a leg or leave you with a system that only we understand.

To get a free consultation, visit this page: “Hire An Expert.”

How to Create an Accounting Database in 3 Steps

Building an accounting database usually requires technical knowledge that someone working in finance and accounting might not have. For instance, you’d need a substantial understanding of database languages like SQL, not to mention the front-end development for user interaction.

Five is an online database builder designed to make creating a customizable accounting database much faster.

Creating an accounting database with Five won’t be entirely effortless, but it will be significantly easier than spending 60+ hours learning various coding frameworks and languages. In addition, with Five, your database is fully customizable and adjustable, exactly tailored to the way you need it to run your business. Add custom fields and track whatever you wish in your accounting database.

With Five, you can:

✅ Set up your database in minutes.

✅ Let Five auto-generate a user-friendly web interface for your database.

✅ Import your existing accounting data from Excel, Google Sheets, or CSV files, allowing you to get started quickly.

Five also offers the flexibility to create custom business logic with code, generate PDF documents, and visualize your data through custom charts and dashboards.

Additionally, you can set up email notifications for your team and management, ensuring critical data or information is shared without delay.

Get free access to Five here and start building an accounting database.

Step 1: Map Out Your Financials

Accounting databases need to be as comprehensive as possible: any financial data that is missed can lead to costly errors.

The entities included in a typical accounting database schema are:

1. General Ledger

2. Transactions

3. Accounts Receivable

4. Accounts Payable

5. Payroll

6. Assets

7. Liabilities

8. Equity

9. Budgeting

10. Financial Reporting

These attributes help ensure that an accounting database provides comprehensive and organized financial data, enabling accurate tracking, reporting, and analysis for effective financial management.

Step 2: Define Other Important Information, Reports or Charts

Apart from storing financial data, your database is supposed to inform your decision-making.

Looking at a raw general ledger is usually not very helpful. Reports, charts, or dashboards are much more suitable for supporting effective decision-making.

Define what interfaces you would like to have together with your database: who needs access to what? Who should be in charge of data entry? Who should have read-only access?

These questions lead you to think about how your database can add value to your business.

Step 3: Creating Your Accounting Database

Your list of accounting attributes and other important information is ready? Great, let’s move all of this into a proper database.

To do so, sign up for Five, an online database builder. Five gives you a simple point-and-click interface for creating relational databases.

Follow our video tutorial to build your database tables, forms, and reports:

Accounting Database Schema and Features

Database Schema

Here’s a typical database schema for an accounting database:

General Ledger (GL)

- Attributes: Account ID (PK), Account Name, Account Type, Account Balance, Date.

- Relationships: None directly, but this table is central to the accounting system.

Transactions

- Attributes: Transaction ID (PK), Transaction Date, Description, Debit Account (FK), Credit Account (FK), Amount, Reference Number.

- Relationships:

- Linked to General Ledger via Debit Account and Credit Account (FKs).

Accounts Receivable (AR)

- Attributes: Invoice ID (PK), Customer ID (FK), Invoice Date, Due Date, Invoice Amount, Amount Paid, Balance Due.

- Relationships:

- Linked to Customers via Customer ID (FK).

Accounts Payable (AP)

- Attributes: Bill ID (PK), Vendor ID (FK), Bill Date, Due Date, Bill Amount, Amount Paid, Balance Due.

- Relationships:

- Linked to Vendors via Vendor ID (FK).

Payroll

- Attributes: Employee ID (PK), Payroll Date, Gross Pay, Net Pay, Tax Withheld, Deductions.

- Relationships:

- Linked to Employees via Employee ID (FK).

Assets

- Attributes: Asset ID (PK), Asset Name, Purchase Date, Purchase Price, Depreciation Method, Accumulated Depreciation, Net Book Value.

- Relationships: None directly.

Liabilities

- Attributes: Liability ID (PK), Liability Type, Origination Date, Due Date, Original Amount, Outstanding Balance.

- Relationships: None directly.

Equity

- Attributes: Equity Account ID (PK), Account Name, Account Balance, Date.

- Relationships: None directly.

Budgeting

- Attributes: Budget ID (PK), Budget Period, Account ID (FK), Budgeted Amount, Actual Amount, Variance.

- Relationships:

- Linked to General Ledger via Account ID (FK).

Financial Reporting

- Attributes: Report ID (PK), Report Type, Period Start Date, Period End Date, Generated Date, Prepared By.

- Relationships: None directly.

In just ten database tables, we have captured the key information for our accounting database and financial management software.

Each table in our database holds specific information, such as transactions, accounts, or assets ensuring a comprehensive and organized data structure. The relationships between these tables facilitate efficient data management, enabling seamless tracking of a business’s financial position.

Accounting Database: Key Features

A Customizable Accounting Database

Using Five’s Table Wizards, we can turn the table and field definitions of our database into working software. Five, an online database builder, comes with a user-friendly, point-and-click database design tool that even non-technical users can quickly get the hang of. Add as many fields as you wish to your accounting database. The database is fully customizable.

Simple-to-Use Forms

Next, Five lets us add forms so that we can enter data into our database. Forms enable us to store or retrieve information from our database. In addition, we can create charts, dashboards, or even PDF reports, which are ideal for quickly generating balance sheets, P&L, or cash flow statements.

Login Protected and Secure

Securing financial data is paramount for organizations of all sizes: Five comes with a pre-built authentication feature that adds a login screen to your application. Only registered users with valid credentials can view or edit data. You can also add multi-factor authentication for extra security.

Generate Documents

Five lets you generate documents straight from inside the application. For example, you can easily create financial reports, balance sheets, or cash flow statements, and build approval workflows for your documents.

Searchable and Online

Our accounting database is searchable and hosted online. It can be accessed by any device and at any time.

Get Started with Five Today

To build your accounting database with Five, sign up for free access and start the process. Once you have signed up, select one of our learning paths to continue your development.

If you need assistance, visit our forum to find help from our application development experts.

By following the steps mentioned above, you can create robust and scalable accounting software tailored to your business needs.