Create an Insurance Portal: A Complete Guide

How to Create an Insurance Portal

Insurance portals have become essential tools in the modern insurance industry, serving as digital platforms that connect insurers, agents, and customers. This guide explores the complete process of creating an efficient insurance portal.

Creating an insurance portal requires careful planning, robust development practices, and ongoing maintenance. Success depends on balancing technical excellence with user experience while maintaining security and compliance standards.

Key Benefits of Insurance Portals

Improve Policy Management

Think about handling insurance policies digitally instead of shuffling through paperwork. That’s exactly what modern insurance portals deliver. Every policy-related task happens in one place – users check their coverage, make changes, and renew policies with just a few clicks. What used to take days now takes minutes, and both insurance teams and customers save countless hours on routine tasks.

Enhanced Customer Experience

Today’s customers expect instant service, and insurance portals deliver exactly that. They can hop online anytime to compare policies, get quotes, submit claims, and check their status. Insurance companies consistently report 40-60% jumps in customer satisfaction after launching these portals. It’s simple – when customers can handle their insurance needs on their schedule, they’re happier with the service.

Reduced Operational Costs

Let’s talk numbers. Insurance companies typically cut their administrative costs by 25-30% after implementing a portal. How? By digitizing paperwork, automating routine processes, and reducing the need for manual customer service. This means less money spent on printing, fewer administrative hours, and lower overhead costs across the board.

Improved Data Analytics

Every click, every quote request, and every policy change in your portal creates valuable data. This information shows you exactly how customers use your services, what they’re looking for, and where they might need help. Insurance companies use these insights to spot trends, improve their offerings, and make smarter business decisions based on real customer behavior.

Cost Transparency

Digital portals make insurance costs crystal clear. Customers see exactly what they’re paying for, with detailed breakdowns of premiums and coverage. This transparency builds trust and helps customers make informed decisions about their insurance needs.

Core Functions of an Insurance Portal

Policy Management

The heart of any insurance portal is policy handling. This includes:

- Creating accurate quotes in real-time

- Issuing new policies quickly and efficiently

- Managing policy renewals and changes

- Tracking policy status and history

Financial Operations

Money matters need careful handling. The portal takes care of:

- Calculating premiums based on risk factors

- Processing payments securely

- Managing refunds and adjustments

- Tracking payment history

- Handling commission calculations for agents

Claims Excellence

A smooth claims process keeps customers happy. The portal enables:

- Easy claim submission with photo/document uploads

- Real-time claim status tracking

- Direct communication between adjusters and claimants

- Fast claims processing and payment

Document Control

Keeping track of paperwork is crucial. The portal provides:

- Secure document storage

- Easy document sharing

- Digital signature capabilities

- Automated form filling

- Version control for important documents

Customer Support

Great service makes all the difference. The portal offers:

- 24/7 access to policy information

- Multiple communication channels

- Self-help resources and FAQs

- Direct messaging with insurance representatives

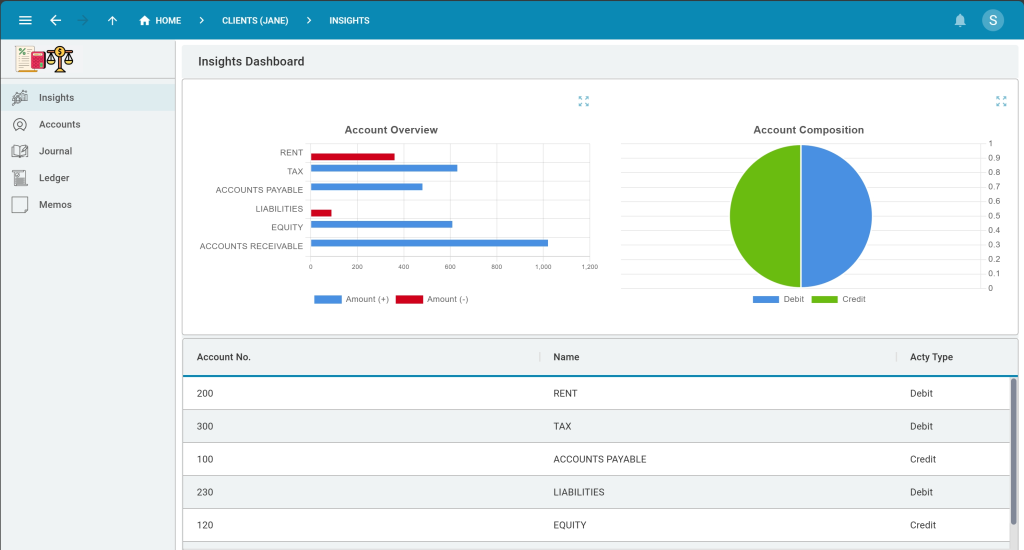

Reporting and Analytics

Knowledge is power. The portal delivers:

- Real-time business insights

- Performance metrics

- Customer behavior analysis

- Risk assessment tools

- Compliance monitoring

Each of these functions works together to create a seamless insurance experience. They’re designed to make insurance more accessible, understandable, and manageable for everyone involved – from customers to agents to insurance company staff.

Technical Requirements

Let’s talk about building your insurance portal. You’ve got two paths ahead: the traditional development route that’s been around for years, and a modern approach that could save you countless hours and headaches. Let me walk you through both.

The Traditional Development Stack

Picture yourself gathering all the pieces needed to build a house from scratch. That’s pretty much what traditional insurance portal development looks like. You’ll need:

Frontend Development: You’d start by choosing a frontend framework like React, Angular, or Vue.js to create your user interface. Each has its learning curve, and you’ll need specialized developers who know these technologies inside and out.

Backend Systems: Then comes the heavy lifting: setting up backend servers with Node.js, Java, or Python. This is where all your business logic lives – everything from processing claims to calculating premiums needs to be coded from the ground up.

Database Architecture: You’ll also need to design and maintain databases using systems like PostgreSQL or MongoDB. Think of this as building the vault where all your important insurance data lives. It needs to be rock-solid and perfectly organized.

Cloud Infrastructure: Finally, you’ll need to set up and manage cloud infrastructure on AWS, Azure, or Google Cloud. This involves handling servers, scaling, security, and making sure everything stays up and running 24/7.

The Modern Approach with Five

Now, let me show you a different way. Five brings a fresh perspective to insurance portal development that could change how you think about building software.

Instead of juggling multiple technologies and frameworks, Five’s platform handles all the technical heavy lifting. You get a complete development environment that’s ready to go – no need to piece together different technologies or worry about compatibility issues.

We’ve taken everything we know about building great insurance portals and baked it right into the platform. Security, scalability, and insurance-specific features are all there from day one.

The Power of Low-Code

With Five, you can build your insurance portal visually, using our low-code platform. This means faster development, fewer bugs, and the ability to make changes quickly as your needs evolve.

Sign Up for Five: Access our low-code platform to start building your portal today.

Five’s Development Services: The Best of Both Worlds

Here’s where it gets even better. You don’t have to choose between doing it yourself and hiring a full traditional development team. Five offers professional development services that combine the speed of our modern platform with expert implementation.

What You Get:

- Expert developers who know insurance inside and out

- A proven development process that delivers results faster

- Full support from initial design through deployment

- The ability to maintain and update your portal yourself after launch

- Significant cost savings compared to traditional development

How It Works:

- We start by understanding your specific needs

- Our team designs and builds your portal using Five’s platform

- You get regular updates and can provide feedback throughout

- We deliver a complete, tested portal ready for your business

- You maintain full control and can make future updates easily

The best part? You’re not locked into expensive ongoing development contracts. Once your portal is live, you can manage it yourself using Five’s intuitive platform, or reach out to our team when you need extra help.

You can visit Five’s Hire An Expert page to learn more and begin building a booking system that works as hard as you do.

The Bottom Line

While traditional development still has its place, building an insurance portal doesn’t have to be a months-long journey involving multiple technologies and teams. Five offers a modern approach that gets you to market faster, with less risk and more flexibility. Whether you choose to build it yourself using our platform or work with our development team, you’ll get a professional, scalable insurance portal that’s ready for the future.

Conclusion: Create an Insurance Portal

Building an insurance portal doesn’t have to be overwhelming. With the right partner and modern tools, you can create something great – a portal that not only meets today’s needs but is ready for tomorrow’s challenges.

Ready to take that first step? Let’s talk about your portal project. Our team is here to help turn your vision into reality, and we’re excited to show you just how simple it can be.