Create A Budget Management System

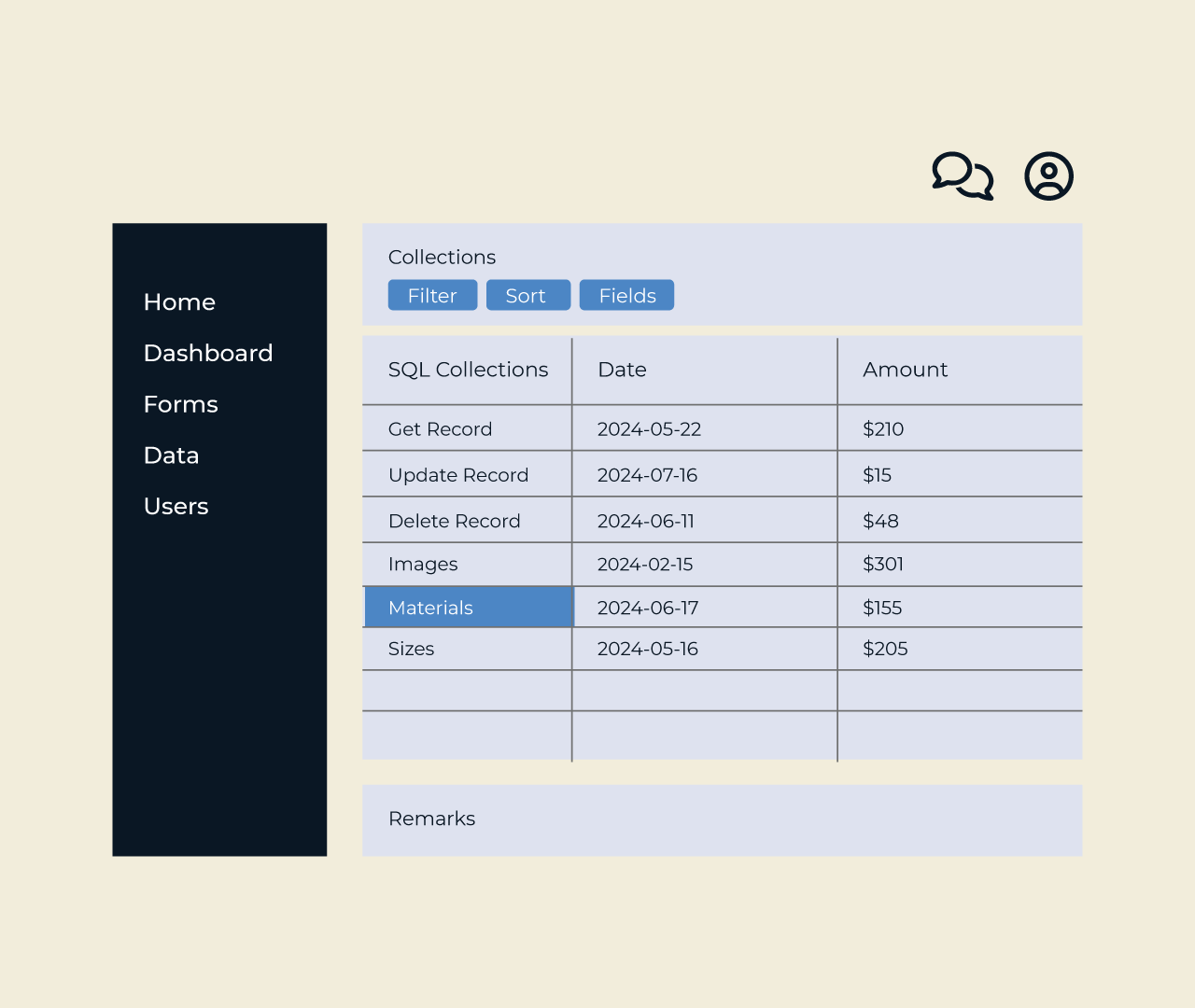

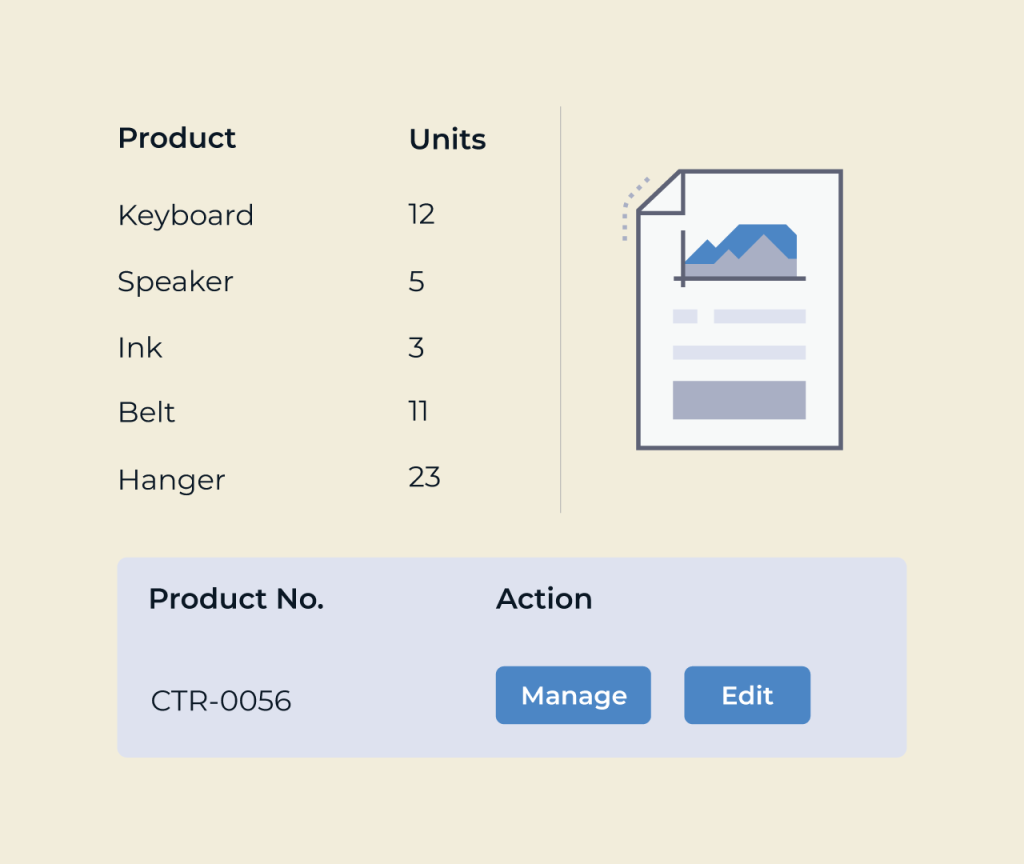

Creating a budget management system is essential for anyone looking to track expenses and manage finances responsibly. With Five, users can easily establish budgets by setting spending limits for various categories, such as groceries, entertainment, and bills. The platform provides insights into spending patterns, helping users make informed decisions about their finances.

Five’s intuitive interface offers customizable features, allowing users to adjust budgets in real time as their financial situation changes. Additionally, automatic alerts notify users when they’re approaching their limits, promoting accountability and encouraging better financial habits. With Five, building an effective budget management system has never been easier.