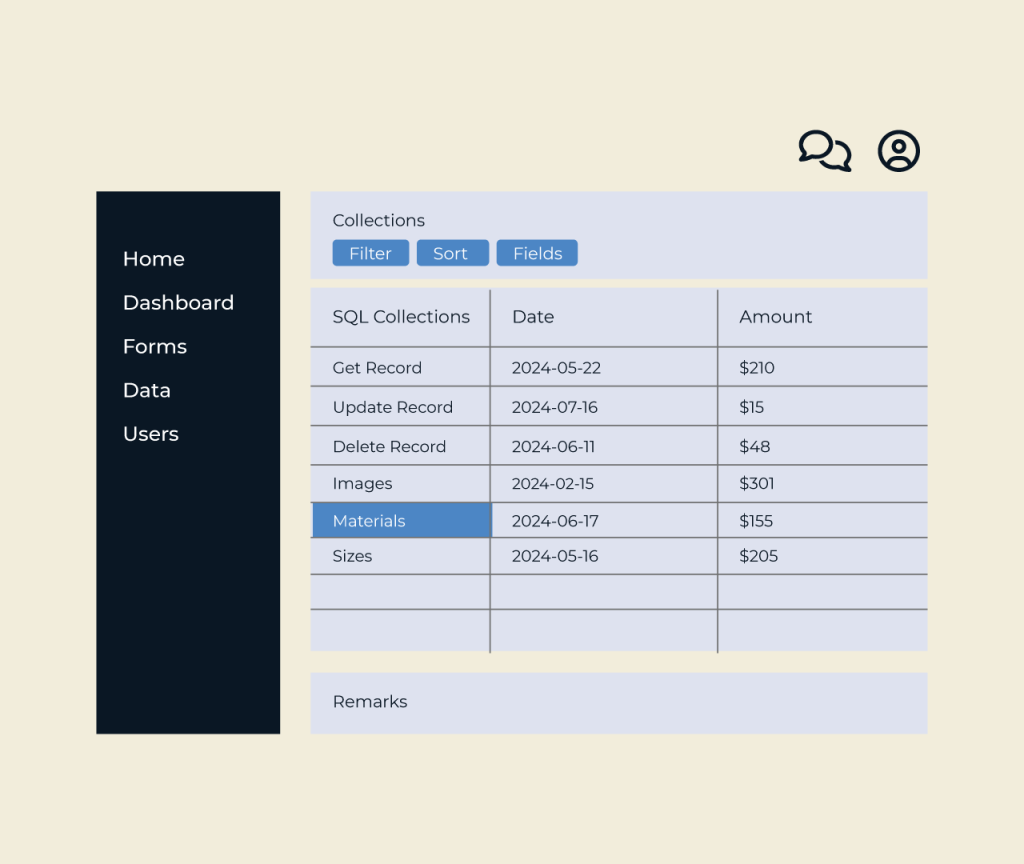

Create a Credit Check Form

Creating a credit check form is essential for assessing the financial reliability of potential customers. Five simplifies this process by providing intuitive tools that allow you to customize your form to meet specific requirements, ensuring that you gather all necessary information efficiently.

With Five, you can easily add fields for personal information, credit history, and consent for credit checks. The platform enables seamless integration with your existing systems, ensuring data is processed securely and quickly. Additionally, you can design a user-friendly interface, making it easy for clients to complete their credit checks with confidence.