Create A Loan Application Form

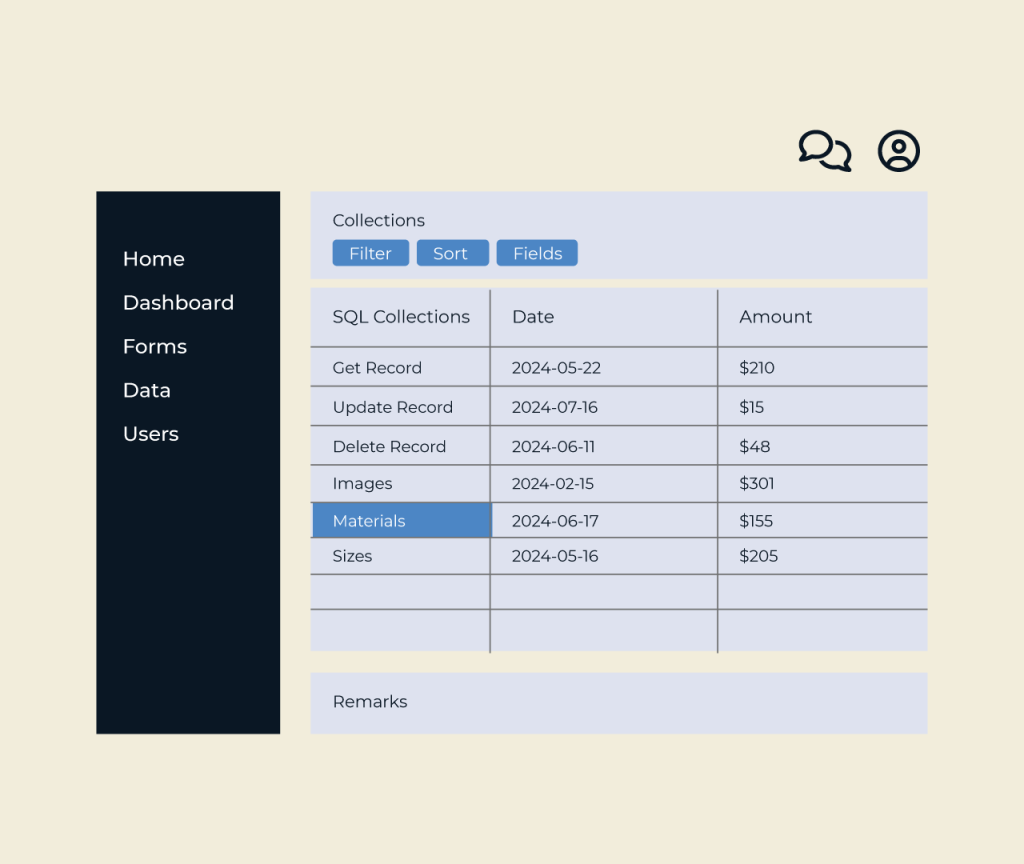

Creating a loan application form is a crucial step in streamlining the borrowing process. With Five, you can easily design a customizable form that meets your specific needs. The intuitive drag-and-drop interface allows you to add fields for personal information, loan details, and financial history without any coding skills.

Five also offers pre-built templates to help you get started quickly. You can adjust the layout and branding to fit your organization’s style while ensuring a user-friendly experience for applicants. With real-time data integration, tracking submissions has never been easier, making your loan application process efficient and effective.