Create A Loan Repayment Dashboard

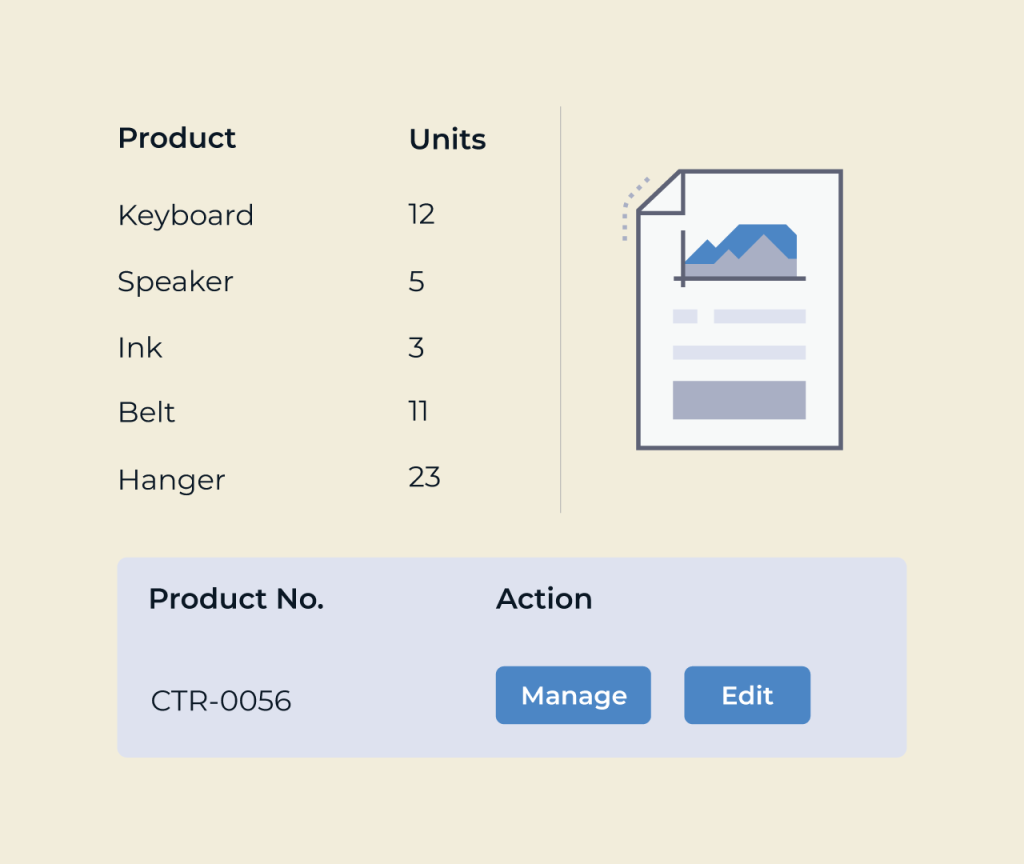

Creating a loan repayment dashboard is essential for tracking and managing your financial obligations effectively. With Five, you can easily build a customized dashboard that provides real-time insights into your loan status, payment history, and remaining balance. By integrating various data points, Five empowers you to visualize your repayment journey and make informed decisions.

The platform’s user-friendly interface allows you to select specific metrics and design your dashboard to suit your needs. You can set up alerts for upcoming payments and explore trends over time, ensuring you stay on top of your financial commitments while maximizing your repayment strategy.