Create a Tax Database

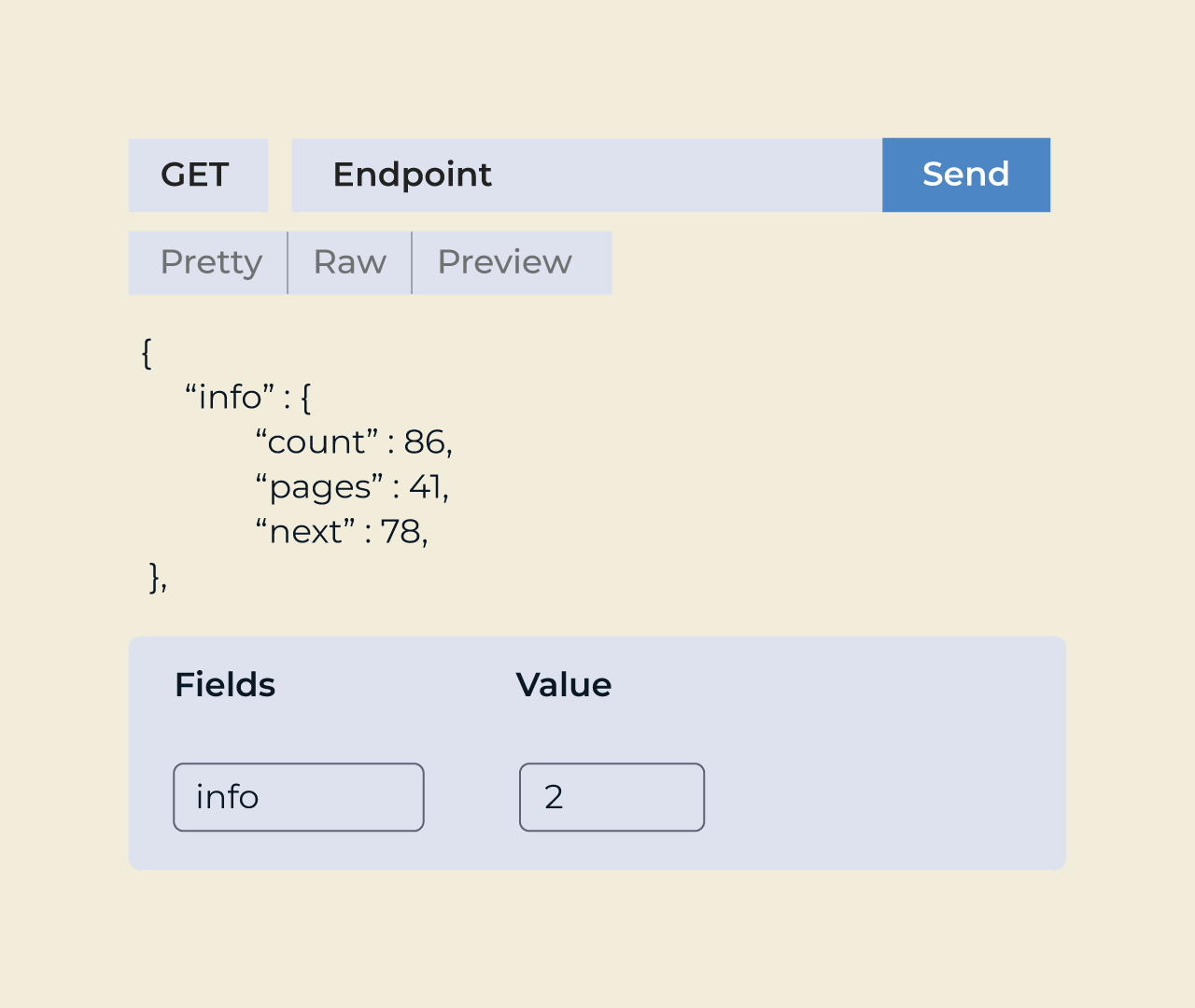

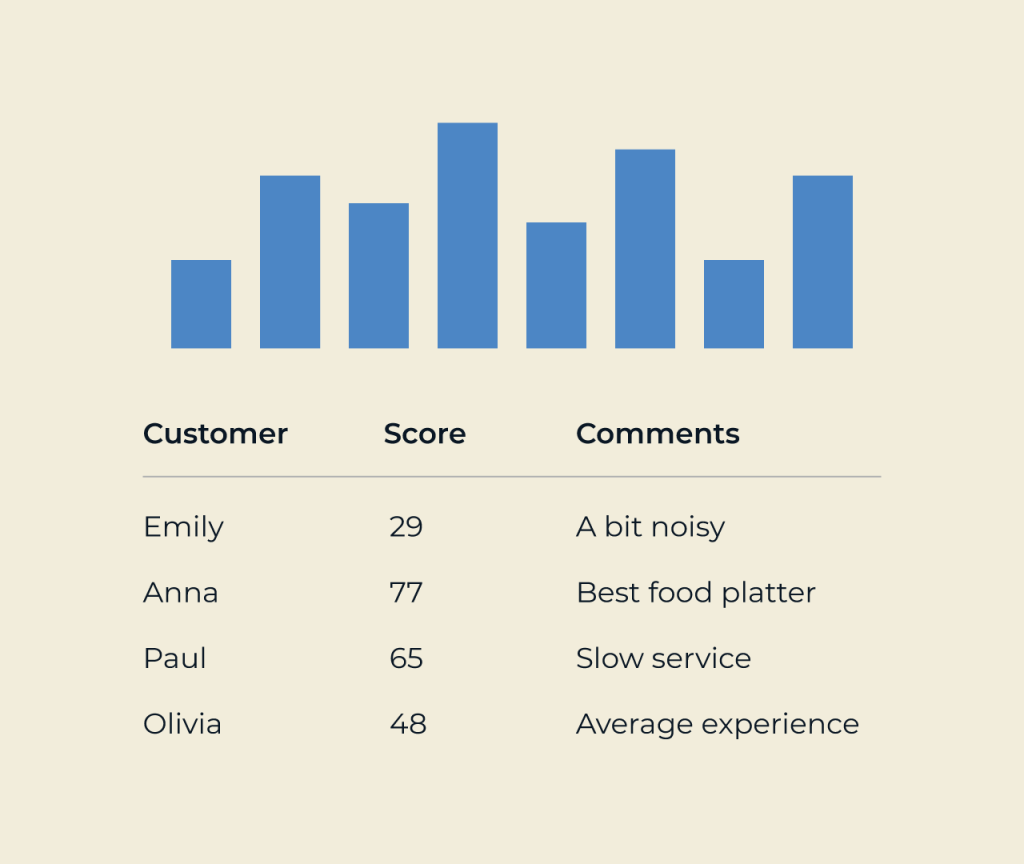

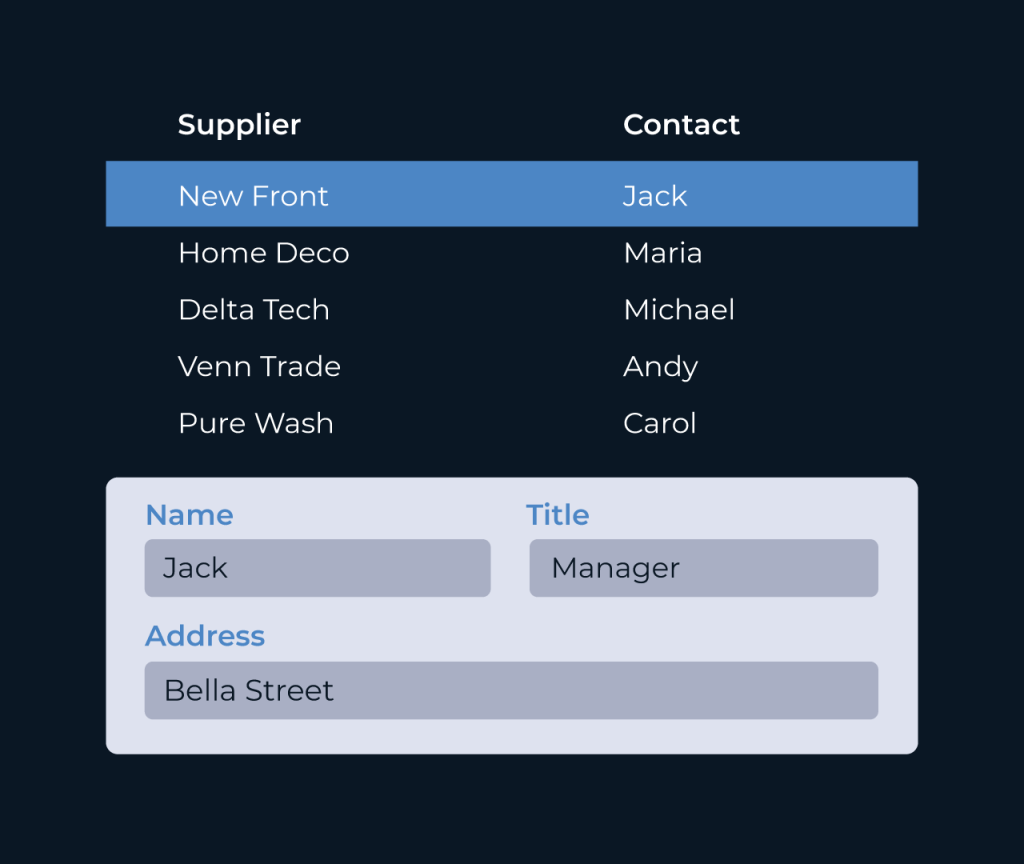

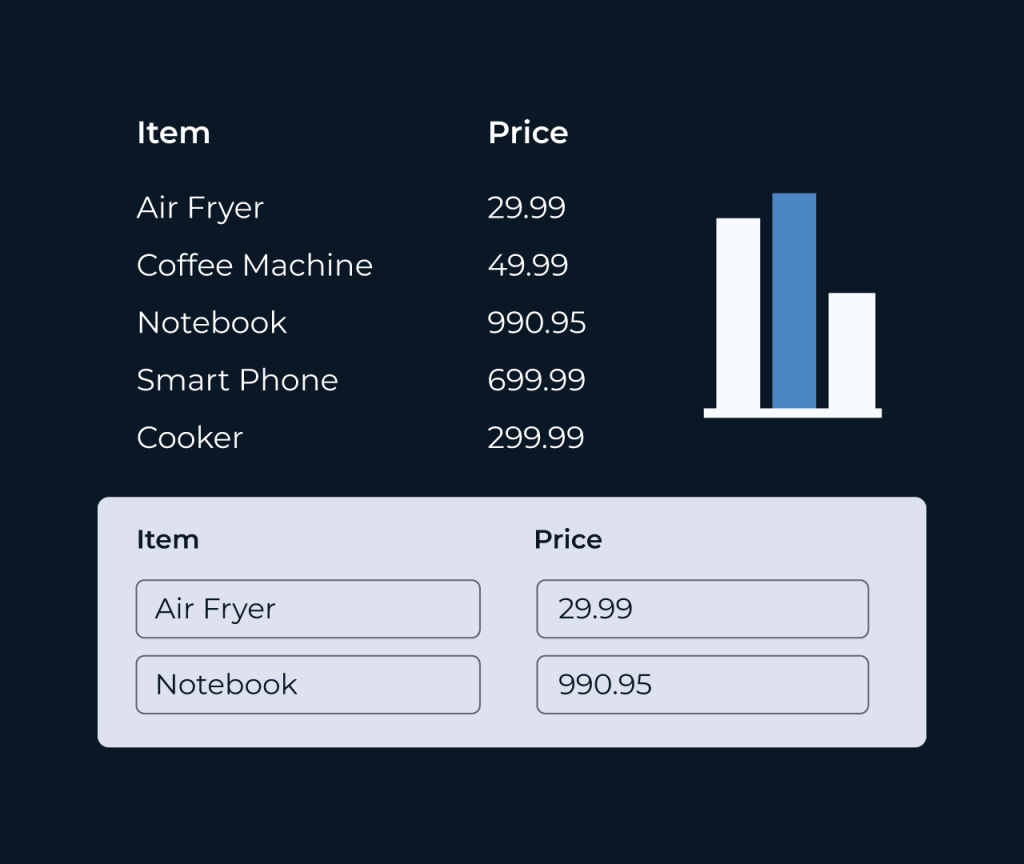

Creating a tax database is essential for effective financial management. Five offers an intuitive platform to build a comprehensive tax database tailored to your specific needs. By integrating various tax categories and customizable fields, Five ensures you can easily track and manage your tax liabilities and deductions.

With Five’s user-friendly interface, users can quickly input, update, and retrieve data. The platform’s robust reporting tools further enhance your ability to analyze tax information, making it easier to comply with regulations and optimize your tax strategy. Leverage Five to streamline your tax management and make informed financial decisions.