Create a Tax Portal

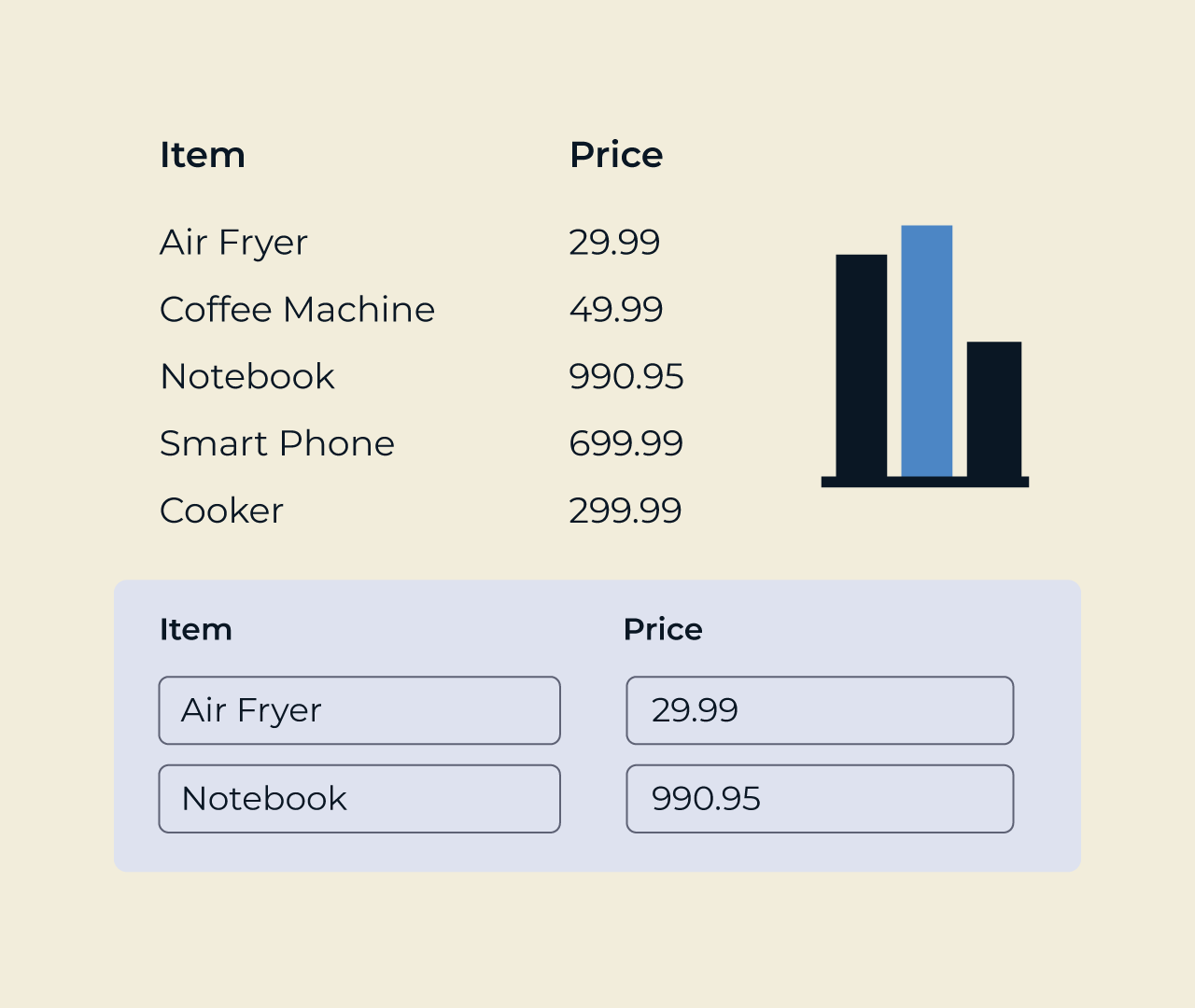

Creating a tax portal has never been easier with Five. Our platform provides intuitive tools that allow you to design a user-friendly interface, making it simple for clients to navigate their tax needs. Users can access forms, submit documents, and track their filing status—all in one place.

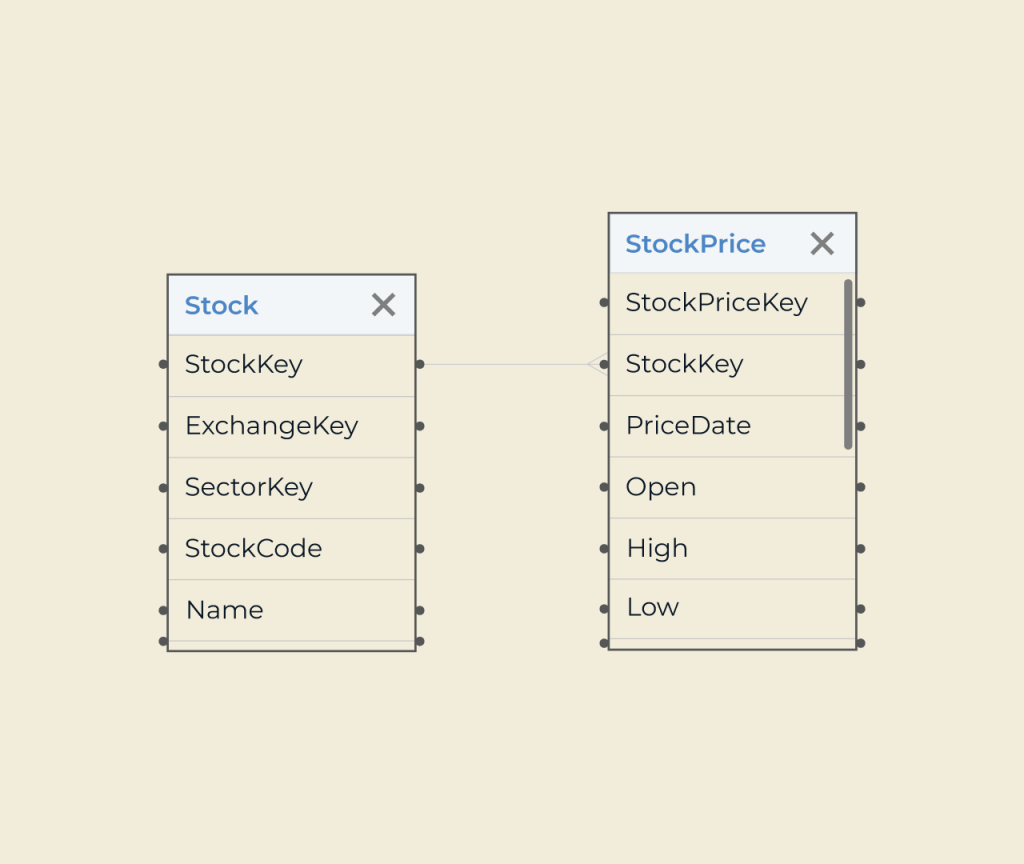

Five’s flexible API integrations enable seamless connection with existing tax software, ensuring that all data is synchronized in real-time. With customizable features, you can tailor the portal to match your branding and specific requirements, giving you complete control over user experience while enhancing client satisfaction.